The NFT staking platform market is poised for significant growth, driven by increasing adoption, technological advancements, and evolving decentralized finance (DeFi) applications.

A new report from WMR, titled NFT Staking Platform Market Research Report 2025-2032, outlines key trends, industry drivers, and competitive dynamics shaping this emerging sector. The report, which includes over 100 data tables, pie charts, and graphical representations, provides an in-depth analysis of the market’s projected expansion through 2032.

Competitive Landscape and Market Positioning

As the NFT staking sector grows, companies are vying for market share in an increasingly competitive environment. The WMR report emphasizes the importance of understanding market dynamics to avoid potential downturns in shareholding. Market share analysis remains crucial, allowing businesses to track their position relative to competitors and identify areas for growth.

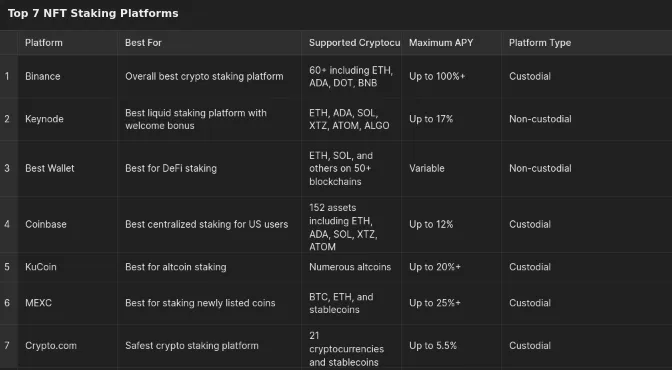

Prominent players in the space, including Binance, OKX, Doge Capital, Bybit, and Kucoin, are adopting aggressive strategies to enhance their market standing. These companies are leveraging technological advancements and expanding staking opportunities to attract users seeking passive income and increased NFT utility. As the market matures, competition is expected to intensify, leading to greater innovation and refinement in staking services.

Understanding NFT Staking: Process and Benefits

NFT staking has emerged as a lucrative mechanism for NFT holders, allowing them to generate rewards while retaining ownership of their assets. This process involves locking NFTs in a smart contract for a specific period, earning cryptocurrency or other tokenized rewards in return. The approach mirrors traditional cryptocurrency staking, wherein token holders support network operations in exchange for incentives.

The benefits of NFT staking include passive income generation, enhanced utility for NFTs, and increased engagement within NFT communities. As more users participate, staking also contributes to liquidity within the market. NFT holders who engage in staking may gain additional benefits such as governance rights within decentralized projects, further integrating them into the evolving DeFi ecosystem.

Potential Risks and Market Challenges

Despite its advantages, NFT staking is not without risks. Market volatility remains a significant concern, as fluctuating NFT values may impact both the rewards earned and the overall asset worth. Additionally, technical vulnerabilities in smart contracts pose potential risks, with exploits or bugs potentially leading to asset losses.

Illiquidity is another challenge, as staked NFTs are typically locked for a predetermined period, restricting immediate access. Furthermore, regulatory uncertainty continues to loom over the sector, with potential legal shifts impacting staking agreements and platform operations. Industry stakeholders must remain vigilant in addressing these risks while ensuring security measures are in place to protect users and assets.

Future Outlook: Expansion and Innovation

The NFT staking landscape is expected to evolve further as new projects and platforms integrate staking mechanisms to increase NFT functionality. Innovations such as cross-chain staking solutions, enhanced reward structures, and improved security protocols are likely to drive continued adoption.

As NFTs extend beyond digital art and collectibles into gaming, virtual real estate, and intellectual property, staking models will play an integral role in shaping their utility. The intersection of NFTs and DeFi presents new opportunities for both investors and creators, solidifying NFT staking as a foundational component of the blockchain ecosystem.