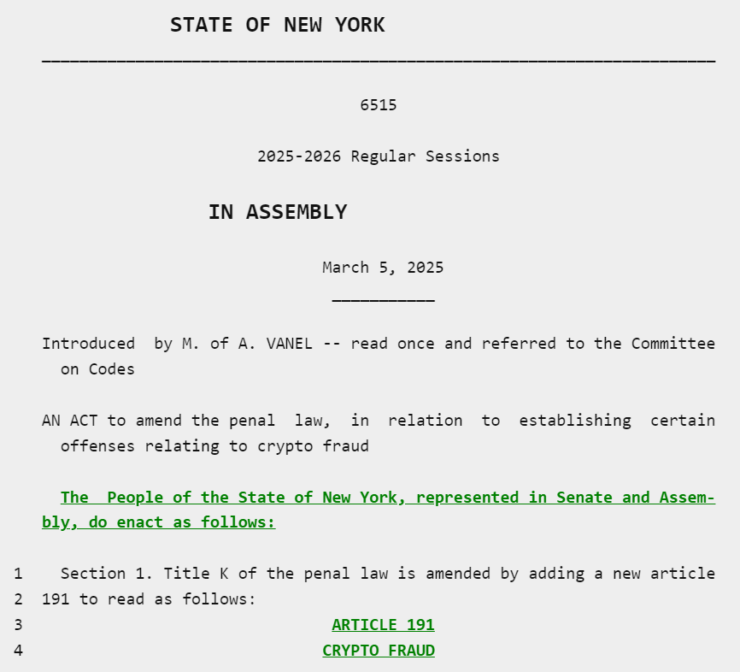

New York lawmakers are stepping up efforts to combat fraudulent memecoin schemes with a newly proposed bill that seeks to criminalize rug pulls and enhance investor protection in the crypto market. The legislation, introduced by Assemblymember Clyde Vanel on March 5, could mark a turning point in regulatory oversight for digital assets, particularly in the wake of high-profile memecoin scams that have wiped out billions in investor funds.

Bill A06515, proposed in the New York State Assembly, aims to introduce criminal penalties for deceptive practices involving cryptocurrencies, particularly those tied to “virtual token fraud.” This would specifically target insiders who orchestrate rug pulls, where developers or key figures abandon a project, drain liquidity, and leave investors with worthless tokens.

The bill defines “virtual tokens” to include security tokens and stablecoins, making it applicable to a wide range of digital assets. Additionally, security tokens are described as “any form of fungible or non-fungible computer code stored on a peer-to-peer network,” ensuring the law covers various blockchain-based financial instruments.

Cracking Down on Memecoin Scams

The introduction of this bill follows a series of high-profile rug pulls that have shaken investor confidence in the memecoin sector. A notable example is the Libra memecoin scandal, where insiders allegedly siphoned off $107 million, triggering a 94% price collapse in hours and erasing $4 billion in investor capital.

The Solana-based memecoin frenzy has also seen a surge in scams, leading to $485 million in capital outflows as investors seek safer assets. Regulatory intervention has become a pressing issue, given the scale of financial damage caused by unregulated crypto projects.

Anastasija Plotnikova, co-founder and CEO of blockchain regulatory firm Fideum, in an interview with Cointelegraph noted that memecoin scams should fall squarely within law enforcement’s jurisdiction. She argues that rug pulls are not only unethical but also clearly illegal, with established legal precedents supporting enforcement action.

“These activities should fall firmly within the jurisdiction of law enforcement agencies,” Plotnikova stated, emphasizing that insider fraud in crypto markets should not go unchecked.

The Libra case has uncovered deeper concerns, including allegations that insider circles within memecoin trading groups were aware of the rug pull weeks in advance. Reports indicate that some members of the Jupiter decentralized exchange (DEX) knew about the token launch and its eventual collapse long before it went public.

What This Means for Crypto Regulation

New York’s proposed legislation could set a precedent for other jurisdictions looking to regulate memecoin markets and protect retail investors from fraudulent schemes. If passed, this bill would significantly increase accountability in the crypto space, potentially forcing developers and insiders to disclose financial risks upfront.

As regulatory scrutiny increases, crypto projects may face tighter compliance requirements, leading to greater transparency and safer trading environments. However, the challenge for lawmakers will be striking a balance between innovation and regulation ensuring the crypto industry continues to evolve without stifling growth.

With rising political and legal interest in crypto regulation, the New York bill could be a game-changer, signaling that the era of unchecked memecoin scams may be coming to an end.