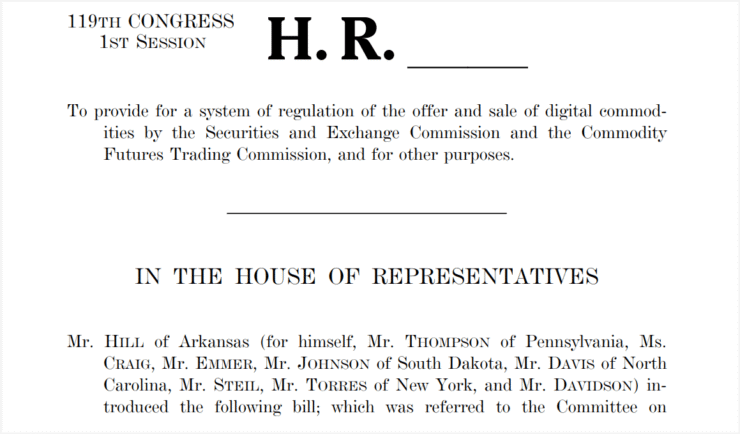

In a long-anticipated move, U.S. lawmakers have introduced a bipartisan bill aimed at finally resolving one of the most contentious issues in crypto regulation: which federal agency governs what. The Digital Asset Market Clarity Act of 2025, or CLARITY Act, proposes a formal split in oversight duties between the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC)—a division that could reshape the entire U.S. crypto landscape.

Unveiled by Representative French Hill, a long-time Republican advocate for digital asset reform, the legislation has garnered bipartisan support, including backing from three Democratic co-sponsors. Hill called the bill a result of “extended deliberation across party lines,” noting that it builds upon the work of the 118th Congress.

“Our bill brings long-overdue clarity to the digital asset ecosystem, prioritizes consumer protection and American innovation,” Hill said.

The legislation aims not only to settle jurisdictional disputes but also to provide more reliable guidance for crypto developers, exchanges, and investors navigating a fragmented U.S. regulatory environment. Lawmakers expect more detailed provisions—including precise definitions of what qualifies as a security or commodity—to emerge during upcoming committee hearings.

Rules Tighten for Crypto Developers and Platforms

Beyond establishing regulatory lines, the CLARITY Act introduces rigorous operational rules for the broader digital asset industry. Developers will be required to submit transparent protocol disclosures that detail system architecture, governance mechanisms, and any controlling entities.

Crypto intermediaries—such as brokers, dealers, and trading platforms—would also be held to higher compliance standards. These include asset segregation, proactive risk disclosures, and a structured registration process overseen by relevant regulators.

In addition, the bill sets the foundation for a federal licensing regime, granting compliant firms the ability to legally operate across the United States under a unified regulatory framework.

Democratic co-sponsor Ritchie Torres emphasized the urgency of ending the regulatory gray area.

“The CLARITY Act will deliver clear rules of the road that entrepreneurs, investors, and consumers deserve,” he said.

This legislation builds on earlier proposals, such as the FIT21 Act, which passed the House but stalled in the Senate. The CLARITY Act originated in April within the House Subcommittee on Digital Assets, Financial Technology, and AI, reflecting increasing congressional urgency to formalize crypto rules.

Congress Eyes Year-End Votes on Key Crypto Bills

The CLARITY Act is just one of several crypto-related bills advancing in Congress. Lawmakers are also pushing for final votes on two landmark pieces of legislation: a market structure bill and a stablecoin regulatory framework.

Representative Ro Khanna expressed optimism that both bills could pass by year-end, citing bipartisan momentum. Of particular note is the GENIUS Act, which focuses on regulating stablecoins and their issuers. It has already passed a procedural vote in the Senate and now awaits full consideration.

The Trump administration has endorsed the GENIUS Act as a vital step in preserving U.S. dollar dominance in a rapidly digitalizing global economy. Treasury Secretary Scott Bessent and Crypto Advisor David Sacks have been vocal proponents, portraying the bill as a necessary safeguard for innovation and monetary sovereignty.

However, not all lawmakers are aligned. Some Democrats remain skeptical, concerned about the bill’s political ties to Trump-aligned crypto figures. Despite this, the legislative momentum signals that crypto regulation is no longer a fringe issue—it now occupies a central place in Washington’s financial agenda.

Quick Facts

- The CLARITY Act of 2025 seeks to divide crypto oversight between the SEC and CFTC.

- Developers and intermediaries will face stricter disclosure and compliance rules.

- The bill proposes a federal licensing framework for crypto firms operating in the U.S.

- The GENIUS Act, backed by the Trump administration, regulates stablecoins and is nearing final Senate approval.

- Congress aims to pass both the CLARITY Act and GENIUS Act by year-end 2025.