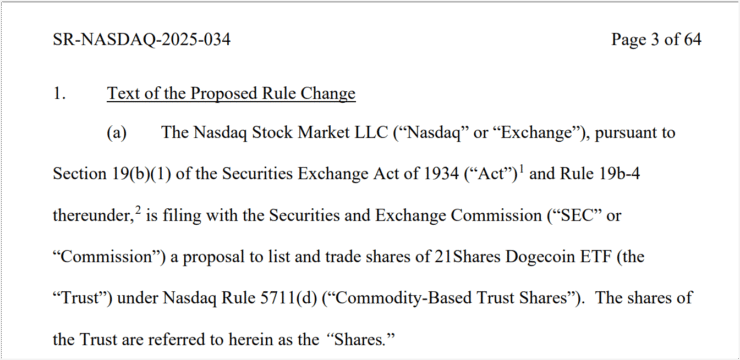

Nasdaq has submitted a formal request to the U.S. Securities and Exchange Commission (SEC) for a rule change that would allow it to list a spot Dogecoin exchange-traded fund (ETF) from crypto asset manager 21Shares. The filing was made under the SEC’s 19b-4 rule, a standard requirement for proposed listing changes, though it does not guarantee approval.

The 21Shares Dogecoin ETF is designed to track the real-time price of DOGE, following a structure similar to recently approved spot Bitcoin and Ethereum ETFs. By offering direct exposure to the popular meme coin, the fund would let investors gain access to Dogecoin without using crypto exchanges or managing self-custody wallets.

21Shares is one of several firms racing to bring a Dogecoin ETF to market. Bitwise filed a similar proposal in January, followed shortly by Grayscale, which also expressed interest in launching a comparable product. Earlier this month, 21Shares submitted an S-1 registration statement, another key step in the regulatory process.

Dogecoin ETF Filings Multiply as Momentum Builds

What once seemed improbable is now progressing rapidly through the U.S. regulatory landscape: a spot Dogecoin ETF. As crypto ETFs enter a new era of institutional interest, Dogecoin is becoming one of the most closely tracked altcoins in the battle for SEC approval.

Following Nasdaq’s application to list the 21Shares Spot Dogecoin ETF, analysts say a decision from the SEC could arrive before the end of the year. The commission has already started reviewing Grayscale’s Dogecoin ETF proposal, filed through NYSE Arca, which triggered a 240-day review period after being published in the Federal Register in February.

21Shares, Bitwise, and Grayscale all plan to structure their ETFs as commodity-based trusts, similar to the approach used for Bitcoin and Ethereum ETFs. However, Rex Shares, a Miami-based firm, may gain an edge by filing under the Investment Company Act of 1940 (the “40 Act”), which governs funds that may hold both crypto and derivatives. This route includes a shorter, 75-day review window.

Dogecoin Foundation Backs ETF, Price Climbs

Adding to the momentum behind the 21Shares proposal, the Dogecoin Foundation’s commercial arm, House of DOGE, has expressed public support for the fund. The foundation previously backed a Dogecoin exchange-traded product (ETP) launched by 21Shares on Switzerland’s SIX Swiss Exchange and sees the U.S. listing as a major step in bringing Dogecoin into regulated financial markets.

With a market capitalization of $76.3 billion, Dogecoin remains the eighth-largest cryptocurrency and continues to lead the meme coin sector. Over the past week, DOGE has risen 6.3% to $0.18, buoyed by rising investor interest and the perceived legitimacy that ETF proposals are bringing to the project.

Quick Facts

- Nasdaq filed with the SEC to list the 21Shares Spot Dogecoin ETF and offer direct exposure to DOGE.

- The fund will hold actual Dogecoin tokens, with Coinbase Custody Trust Company acting as custodian.

- Over 70 crypto ETF applications are currently under SEC review, signaling institutional interest.

- Approval could mark a turning point for Dogecoin’s mainstream acceptance in financial markets.