In a fresh signal of rising institutional interest in Layer-1 blockchain projects, Nasdaq has officially filed Form 19b-4 with the U.S. Securities and Exchange Commission (SEC) to list the 21Shares Polkadot (DOT) Spot ETF. If approved, the fund would offer regulated exposure to Polkadot’s native cryptocurrency DOT—without the complexities of direct ownership.

The move comes amid a broader industry push to diversify crypto-backed ETFs beyond Bitcoin and Ethereum, setting the stage for altcoins like Polkadot to enter the mainstream investment landscape.

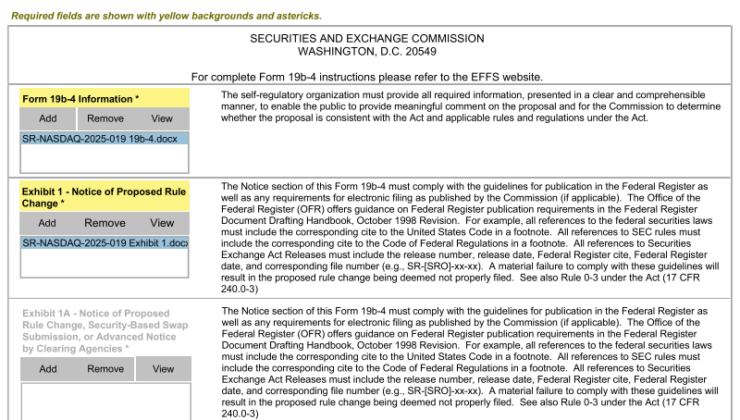

The 19b-4 filing outlines a clear goal: give investors access to Polkadot’s market performance via a traditional investment vehicle. Sponsored by 21Shares, the ETF would track the spot price of DOT, currently the 27th largest cryptocurrency by market capitalization.

This development follows 21Shares’ recent S-1 amendment, detailing plans for regulated digital asset ETFs, not just for Polkadot but also for Solana and XRP. The firm’s growing ETF pipeline reflects a strategic bet on the next wave of blockchain projects poised for institutional adoption.

“21Shares aims to create secure, regulated pathways for investors to participate in digital assets without handling the underlying tokens,” the filing noted.

Competition Heats Up – Grayscale Eyes Polkadot ETF

21Shares isn’t the only firm racing to launch a Polkadot fund. Grayscale Investments, a major crypto asset manager, has filed its own request for a spot Polkadot ETF, signaling intensified competition for first-mover advantage in the altcoin ETF space.

The growing interest reflects Polkadot’s unique value proposition: a layer-0 protocol focused on interoperability, allowing separate blockchains to connect and communicate—an increasingly attractive narrative for investors looking beyond Bitcoin’s store-of-value role.

Despite the flurry of filings, the SEC has been slow to greenlight altcoin ETFs. Recent delays on ETFs tied to XRP, Solana, Litecoin, and Dogecoin show that regulatory uncertainty still clouds the path forward.

Adding complexity, 21Shares is also pushing a staking feature for its Core Ethereum ETF, hinting at a future where ETFs not only track prices but also generate yield from network participation—an ambitious leap for regulated financial products.

Polkadot Sees Modest Gains, but Volatility Persists

Following Nasdaq’s filing, Polkadot’s DOT token saw a brief price uptick, driven by hopes that a spot ETF could bring new inflows and legitimacy to the project. However, those gains quickly faded, with DOT down 1.12% at the time of writing.

DOT now trades near $6.7 billion in market capitalization, testing support levels at $4.322, $4.129, and $3.826. Resistance lies ahead at $4.599 and $4.898, posing hurdles for any immediate bullish momentum.

The mixed response highlights a familiar trend—ETF announcements spark interest, but regulatory bottlenecks temper investor enthusiasm.

Nasdaq’s move to back the 21Shares Polkadot ETF is more than another crypto filing—it’s a sign that institutional players see value in diversifying beyond Bitcoin and Ethereum. Polkadot’s inclusion reflects growing recognition of interoperability projects and Layer-1 blockchains as critical components of the future digital economy.

However, the path ahead is uncertain. Regulatory clarity remains the key hurdle, and until the SEC signals a willingness to approve altcoin ETFs, market reactions will likely remain muted.

Final Takeaway

The 21Shares Polkadot ETF could mark a major milestone for altcoin integration into regulated markets if approved. For Polkadot, it represents an opportunity to expand institutional adoption and build long-term price stability.

For now, all eyes are on the SEC. Its decision on this filing could determine whether Layer-1 blockchain projects like Polkadot gain the same Wall Street foothold that Bitcoin ETFs recently secured or remain confined to crypto-native markets.