As crypto markets surge with volatility and speculation, analysts are raising alarms about a growing wave of misleading narratives flooding social media and market commentary. These claims, often driven by sensationalist sentiment rather than factual on-chain data, are distorting investor perceptions and fueling risky behavior.

In a fast-moving industry where narratives shape market moves, separating fact from fiction is becoming harder and more important than ever.

CryptoQuant contributor “Onchained” highlighted the issue in a recent market report, urging investors to stay alert. The analyst debunked claims that Bitcoin long-term holders (LTHs) — wallets holding BTC for over 155 days — are “capitulating” amid market uncertainty.

“The data leaves no room for speculation,” Onchained wrote, pointing to the Inactive Supply Shift Index (ISSI), which measures dormant Bitcoin moving on-chain. The metric shows no significant sell-side pressure from long-term holders, directly challenging the bearish narrative.

Instead, the data suggests structural demand continues to outpace supply, a bullish signal contradicting the online noise.

Glassnode and Other Experts Echo Similar Warnings

Analytics platform Glassnode backed these findings, noting that long-term holders remain largely inactive, with sell pressure at historically low levels. Yet, narratives of impending Bitcoin collapse persist, fueled by fear and exaggerated social media commentary.

The pattern is clear: narratives in crypto markets are constantly shifting, often without support from objective analysis.

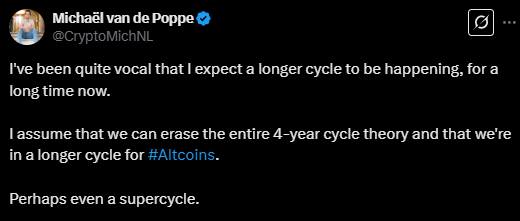

One of the most debated topics is the relevance of the Bitcoin 4-year cycle theory, which is historically linked to BTC’s halving events. Some analysts now argue that this theory is outdated.

Michael van de Poppe, founder of MN Trading Capital, declared that “the 4-year cycle is over”, suggesting the market is entering a longer, more complex altcoin-driven cycle.

Adding weight to that view, Bitwise CIO Matt Hougan said shifting U.S. policies have broken traditional market cycles.

“Crypto has moved in four-year cycles since its earliest days. But the change in D.C. introduces a new wave that will play out over a decade,” Hougan argued.

Are We at the End of the Bitcoin Bull Cycle? Some Analysts Think So

Amid all the conflicting narratives, some voices — like CryptoQuant CEO Ki Young Ju, warn that Bitcoin’s bull cycle may already be over. Ju cites drying liquidity and new whales selling BTC at lower prices as signs of an impending 6-12 months of sideways or bearish action.

While his bearish outlook contrasts sharply with other analysts’ long-term optimism, it reflects the fragmented and often speculative nature of market commentary today.

The Takeaway

In a market shaped by sentiment as much as fundamentals, misleading narratives thrive — often spreading faster than facts. Analysts warn that unless investors prioritize on-chain data and verify their sources, many risk making costly decisions based on hype, not reality.

As global regulations tighten and market complexity grows, the message is clear: In crypto, data beats noise. Only those who dig deeper will navigate the next cycle safely.