In a surprising political pivot, Minnesota state Senator Jeremy Miller introduced the Minnesota Bitcoin Act, transforming from a vocal Bitcoin skeptic to an active proponent of cryptocurrency adoption.

Miller, once wary of digital assets, now views Bitcoin as a path to economic prosperity and financial innovation for Minnesotans. His proposed legislation would position Minnesota among many U.S. states embracing Bitcoin as part of their financial strategy.

“I’ve gone from being highly skeptical to learning more about it, to believing in Bitcoin and other cryptocurrencies,” Miller said in a statement on March 18.

Miller’s proposal is to allow the Minnesota State Board of Investment to allocate state funds to Bitcoin and other cryptocurrencies, treating them as legitimate assets alongside traditional investments.

The bill also allows Minnesota state employees to add Bitcoin to their retirement accounts, a significant step toward mainstreaming digital assets in personal finance.

Additionally, the legislation proposes allowing residents to pay state taxes and fees in Bitcoin, following in the footsteps of Colorado and Utah, which have already adopted similar measures.

One of the most aggressive provisions is a state income tax exemption on gains from Bitcoin and other cryptocurrencies. This move could attract both retail and institutional crypto investors to Minnesota.

Minnesota Joins a Growing Wave of Pro-Bitcoin States

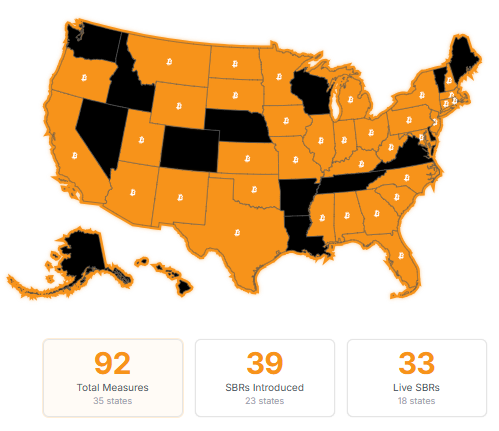

Miller’s proposal comes as 23 U.S. states have introduced or are considering Bitcoin reserve bills, signaling a national trend toward digital asset adoption at the state level.

The momentum gained speed after Senator Cynthia Lummis unveiled the Strategic Bitcoin Reserve Act last year, calling on the federal government to accumulate up to 1 million BTC over five years.

Earlier this month, Lummis reintroduced an updated BITCOIN Act that could push federal holdings even higher.

These efforts reflect a growing belief in Bitcoin’s role as a strategic economic asset and hedge against inflation, especially amid concerns over the U.S. dollar’s long-term stability.

Bitcoin’s Outperformance Adds Fuel to the Legislative Push

Supporters of Miller’s bill point to Bitcoin’s staggering long-term returns as justification for adding it to public investment portfolios.

From August 2011 to January 2025, Bitcoin delivered a compound annual growth rate of 102.36%, dwarfing the S&P 500’s 14.83% over the same period, according to data from Curvo.

For states grappling with pension shortfalls and the need to diversify their investment strategies, Bitcoin’s historical performance is becoming increasingly difficult to ignore.

If passed, Minnesota’s Bitcoin Act could make the state a pioneer in cryptocurrency integration, attracting crypto-forward businesses and investors while setting a precedent for other states considering similar moves.

However, the bill faces familiar hurdles—regulatory uncertainty, market volatility, and potential federal pushback. Still, Miller’s shift highlights an emerging bipartisan understanding that ignoring Bitcoin is no longer an option for states seeking financial innovation.

Final Takeaway

Senator Miller’s reversal is more than personal—it reflects America’s shifting political landscape around Bitcoin. What was once dismissed as speculative hype is now being seriously considered for state balance sheets, retirement funds, and tax systems.

As the U.S. inches toward greater crypto adoption, Minnesota’s Bitcoin Act could be a blueprint for the next wave of legislative action, bridging skepticism and belief in the pursuit of economic resilience and growth.