Hedge fund giant Millennium Management has disclosed a significant expansion of its digital asset exposure in its latest 13F filing with the Securities and Exchange Commission. The filing reveals that the firm now holds approximately $2.6 billion in Bitcoin ETFs and $182.1 million in Ethereum ETFs. This new data arrives amid a broader institutional push into the cryptocurrency market, as traditional finance players continue to explore and diversify into digital assets.

The updated positions build on earlier Q1 disclosures, when institutional investors owned over 20% of Bitcoin ETF shares and Millennium led with nearly $2 billion in holdings. At that time, combined filings from over 1,500 institutional entries reported total Bitcoin ETF ownership of around $10.6 billion. The evolving figures underscore a notable shift in investment strategies, reflecting a growing appetite for crypto-based products among major asset managers.

Millennium Management’s Expansive ETF Portfolio

Millennium’s diversified approach to Bitcoin ETF investments is evident in its detailed portfolio. The firm’s largest holding is in BlackRock’s iShares Bitcoin Trust (IBIT), which accounts for over $844 million.

This is followed closely by Fidelity’s Wise Origin Bitcoin Fund (FBTC) at just over $806 million. Additional allocations include investments in the ARK 21Shares Bitcoin ETF, Bitwise Bitcoin ETF, and the Grayscale Bitcoin Trust (GBTC).

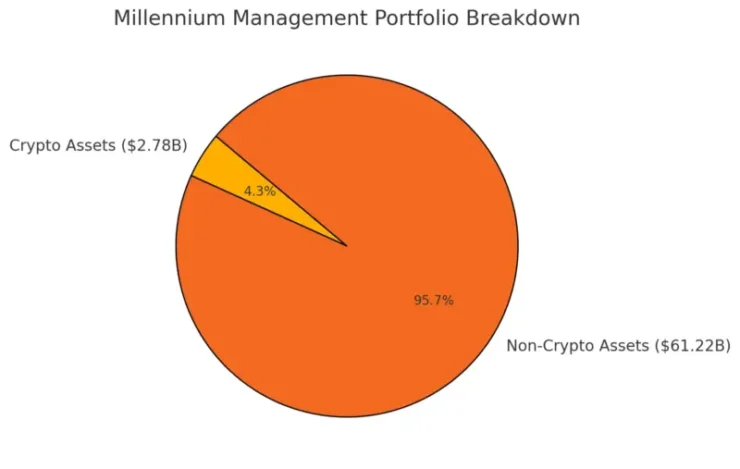

In Q1 filings, the breakdown also highlighted nearly $202 million in Grayscale’s Bitcoin Trust and close to $45 million each in both the ARK 21Shares Bitcoin ETF and the Bitwise Bitcoin ETF Trust. Despite these substantial positions, the holdings represent only about 3% of Millennium’s $64 billion in assets under management—a cautious yet forward-looking stance toward the crypto sector.

Context from Past Filings and Broader Institutional Trends

Historical filing data provides essential context for understanding the current surge in digital asset investments. In Q1 2024, institutional investors reported a combined ownership of roughly $10.6 billion in Bitcoin ETFs, with professional investors accounting for nearly 20% of total ETF shares by the end of March.

Among the top Bitcoin ETF holders, aside from Millennium’s nearly $2 billion stake, firms such as Susquehanna International Group ($1.1 billion), Bracebridge Capital ($404 million), Boothbay Fund Management ($303 million), and Morgan Stanley ($269.9 million) were also prominently featured.

Bitwise’s CIO Matt Hougan commented on the growing momentum in ETF allocations at the time: “…the allocations we see in recent 13F filings are just a down payment. Hightower Advisors may have $68 million allocated to bitcoin ETFs today, for instance, which is great, but it’s just 0.05% of their assets.

If they follow the pattern outlined above, that allocation will build over time. And to put it in context, a 1% allocation of their portfolio to bitcoin would equate to $1.2 billion—all from a single firm.” Hougan added, “Multiply that by the growing number of professional investors participating in the space, and you can begin to see what’s behind my enthusiasm.”

Millennium Management’s updated filings, when viewed alongside previous disclosures, offer a comprehensive snapshot of institutional engagement in crypto ETFs—a trend that continues to reshape traditional investment strategies in the digital asset arena.