Japanese investment firm Metaplanet has further cemented its position in the digital asset space, adding 330 more Bitcoin to its treasury in a bold move that now places the company among the world’s top 10 corporate BTC holders.

The latest acquisition—worth $28.2 million at an average price of $85,605 per BTC—brings Metaplanet’s total Bitcoin holdings to 4,855 BTC, now valued at approximately $414 million. CEO Simon Gerovich confirmed the purchase in an April 21 update, noting that the firm’s Bitcoin portfolio has delivered a 119% return year-to-date.

Metaplanet’s aggressive Bitcoin strategy mirrors that of U.S.-based Strategy (formerly MicroStrategy), but with a uniquely Japanese approach. In late March, the company issued ¥2 billion (roughly $13.3 million) in bonds to finance its BTC buying spree—demonstrating a long-term commitment to integrating Bitcoin into its capital structure.

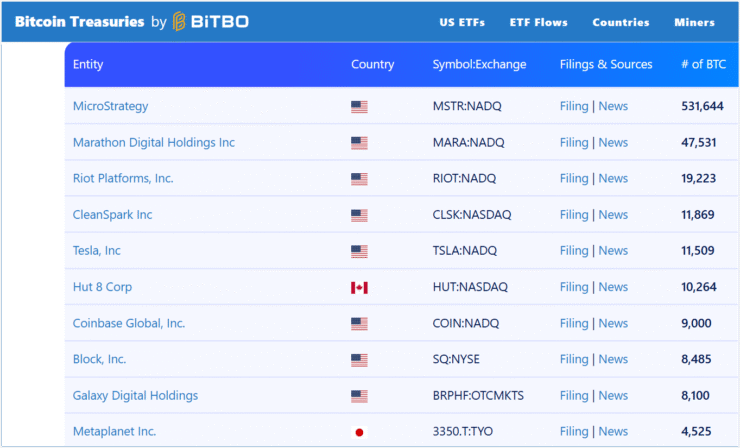

According to Bitbo, this latest move makes Metaplanet the largest corporate Bitcoin holder in Asia and the tenth-largest globally.

Metaplanet Races to Become Asia’s Bitcoin Giant

Metaplanet has outlined an ambitious roadmap to acquire 21,000 BTC by 2026—a bold target that mirrors the conviction-led strategy of MicroStrategy and has earned the firm the nickname “Asia’s MicroStrategy.”

Its most recent $28.2 million purchase of 330 BTC is just one step toward that goal. With current holdings now at 4,855 BTC, the company aims to eventually own about 1 in every 1,000 Bitcoin that will ever exist.

The announcement comes just a week after Strategy (formerly MicroStrategy) disclosed a $285.5 million Bitcoin purchase, bringing its total holdings to 531,644 BTC. Despite the geographic divide, both companies share a common thesis: Bitcoin is the future of institutional treasury management.

While short-term market sentiment remains subdued—pressured by global tariff wars and macro uncertainty—analysts remain optimistic about Bitcoin’s long-term potential. Some forecasts suggest BTC could surpass $1.8 million per coin by 2035, driven by its rising role as a deflationary savings asset and a potential rival to gold’s $21 trillion market cap.

Enmanuel Cardozo, an analyst at asset tokenization platform Brickken, noted that firms like Metaplanet, Strategy, and Tether are reshaping Bitcoin’s traditional four-year halving cycle.

“That puts the bottom around Q3 this year and a peak mid-2026,” Cardozo explained.

“But I think we might see things move a bit sooner because the market’s more mature now with more liquidity.”

If Metaplanet’s vision succeeds, it could emerge as one of the most influential institutional players in Asia’s Bitcoin landscape.

Quick Facts

- Metaplanet’s purchase of 330 BTC brings its total holdings to 4,855 BTC, now valued at over $400 million.

- The firm aims to accumulate 21,000 BTC by 2026 as part of its long-term strategy.

- It is now the largest corporate BTC holder in Asia and ranks tenth globally.

- Metaplanet’s year-to-date return on Bitcoin investments has exceeded 119%.