Quick Facts:

- Raised $25.9 million through bonds with 0.5% interest over 5 years.

- Funds dedicated exclusively to Bitcoin purchases.

- Current Bitcoin holdings are valued at $15 million.

- Inspired by MicroStrategy’s BTC accumulation model.

- Analysts predict growing Japanese institutional interest in crypto.

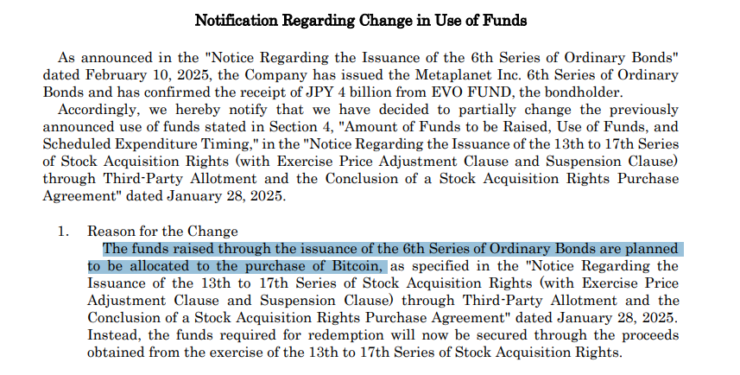

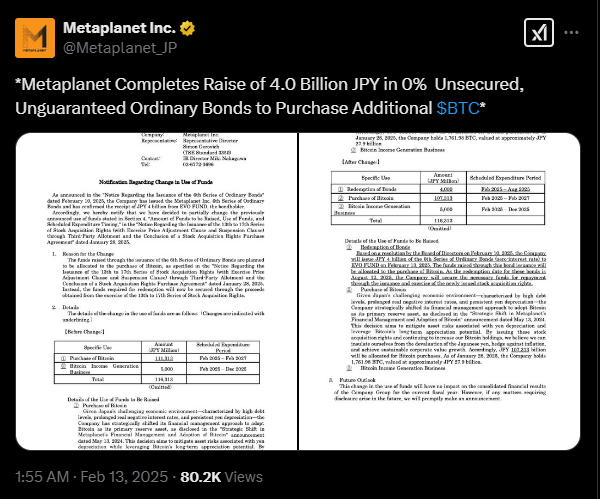

Japanese investment firm Metaplanet Inc. has raised $25.9 million (¥4 billion) through zero-interest, unsecured bonds to expand its Bitcoin holdings. The Tokyo-based firm secured funds from EVO FUND, aiming to increase its Bitcoin reserves to 21,000 BTC by 2026, marking “Asia’s largest ever” Bitcoin raise.

Adjusting its financial plans, Metaplanet will channel all raised funds into Bitcoin as a hedge against Japan’s economic uncertainties, including high national debt and yen depreciation. The bonds, a debt instrument requiring no interest payments, are set for redemption by August 2025.

Metaplanet’s bond, issued with a 0.5% annual interest rate and a 5-year maturity, attracted strong interest from both domestic and global investors. The firm emphasized that every dollar raised will be allocated to purchasing Bitcoin, expanding its digital holdings beyond the current $15 million valuation.

This move cements Metaplanet’s ambition to become Japan’s “MicroStrategy,” drawing comparisons to the U.S. firm known for its aggressive Bitcoin reserves.

Metaplanet’s Bold Bitcoin Pivot Fuels Growth Plans

Metaplanet’s strategic pivot to Bitcoin began in April 2024, mirroring MicroStrategy’s well-known BTC accumulation strategy. Since then, the Tokyo-based firm has aggressively built its holdings, amassing 1,761.98 BTC valued at around $186 million as of January 2025.

The company aims to reach 10,000 BTC by the end of 2025, reinforcing its commitment to Bitcoin despite a slight budget cut. Initially planning $723 million for acquisitions, Metaplanet has revised its target to $717 million through February 2027. This adjustment reflects a careful financial recalibration while maintaining its bullish stance on Bitcoin as a reserve asset.

Metaplanet’s Bitcoin income generation business is another key component of its strategy, set to continue until December 2025. This operation is designed to maximize returns on its growing BTC reserves, providing an additional revenue stream amid market fluctuations.

The firm’s Bitcoin strategy has already yielded remarkable results. In 2024, Metaplanet’s market capitalization surged by an astounding 7,000%, demonstrating the market’s confidence in its crypto-forward approach. The company also reported a significant 309.82% Bitcoin yield in Q4 2024, a notable 41.7% increase from the previous quarter, underscoring the profitability of its Bitcoin investments.

Metaplanet to Join MSCI Japan Index, Boosting Institutional Exposure

Metaplanet is set to be included in the Morgan Stanley Capital International (MSCI) Japan Index on February 28, 2025. This inclusion will expose the Tokyo-based Bitcoin-focused firm to a broader pool of global institutional investors, as funds and ETFs tracking the MSCI Japan Index will automatically add Metaplanet’s stock to their portfolios. The index, which covers large and mid-cap Japanese stocks, could drive significant demand for Metaplanet’s shares, further enhancing its market presence and potentially accelerating its Bitcoin acquisition strategy.