Japanese investment firm Metaplanet has announced a bold move to increase its Bitcoin reserves, issuing ¥2 billion ($13.3 million) in zero-interest bonds to fund further BTC acquisitions. The decision follows a recent board of directors meeting, with the issuance detailed in a corporate filing released earlier this week.

The debt securities will be distributed via Metaplanet’s EVO FUND, with redemption at full face value scheduled by September 30, 2025.

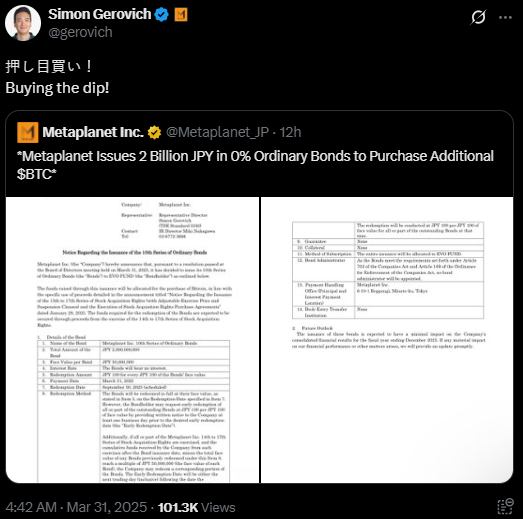

Metaplanet CEO Simon Gerovich summed it up with a three-word post on X:

“Buying the dip!”

Already recognized as Asia’s largest corporate holder of Bitcoin, Metaplanet has reportedly invested over $260 million into BTC since the beginning of its accumulation strategy last year. The company’s latest purchase has lifted its total holdings to approximately 3,200 BTC, placing it 10th globally among corporate Bitcoin treasuries, according to BitcoinTreasuries.net.

By comparison, the list is still led by Strategy (formerly MicroStrategy), the U.S.-based firm helmed by Bitcoin evangelist Michael Saylor.

Metaplanet’s crypto strategy has gained even more attention in recent weeks after the company appointed Eric Trump, son of U.S. President Donald Trump, to its advisory board, further signaling its global ambitions.

“It’s a positive story for BTC where Metaplanet sees the long-term value in owning bitcoin,” said Paul Howard, Senior Director at crypto market maker Wincent.

Markets React Poorly—Stock Down Amid Nikkei Slump

Despite the bullish sentiment from crypto insiders, Metaplanet’s stock fell over 9% following the bond issuance announcement, according to Google Finance data.

The selloff comes amid broader weakness across Japanese equities. The Nikkei 225 dropped 4%, largely in anticipation of new tariffs expected from President Trump on April 2. Analysts note that as one of the first major global markets to open each trading day, the Nikkei often absorbs macroeconomic shocks ahead of its Western counterparts.

“Almost all global markets are seeing the impact of the tariffs from the U.S.,” Howard told The Block. “The expectation is other markets will follow suit on opening.”

Aran Hawker, CEO of CoinPanel, echoed Howard’s concerns, highlighting that short-term headwinds tied to global economic anxiety are weighing on risk-on assets like Bitcoin.

“Whether it’s being driven by the post-holiday catch-up or concerns about a new wave of Trump-era tariffs, it’s clear that macro signals are jittery right now,” Hawker said.

“That sort of backdrop tends to pull capital toward lower-risk assets—at least in the short term.”

Bitcoin has remained volatile in recent weeks, briefly dipping below the $80,000 mark before bouncing back amid fluctuating global sentiment. Still, Metaplanet’s move suggests continued confidence in BTC’s long-term trajectory—even as traditional equities waver.

The Takeaway

While markets remain on edge due to geopolitical and economic crosscurrents, Metaplanet’s latest bond issuance signals unwavering conviction in Bitcoin’s future as a reserve asset.

The company is taking a path few others have dared—leveraging its own debt issuance to stack more BTC on the balance sheet, even as traditional markets turn defensive.

It’s a high-conviction move in uncertain times—and one that may be remembered as either bold or brilliant, depending on how the crypto narrative plays out in the years ahead.