In a move signaling unwavering confidence in Bitcoin’s long-term value, Tokyo-based investment firm Metaplanet has purchased an additional $12.5 million worth of BTC, further cementing its status as one of the most aggressive institutional buyers in Asia.

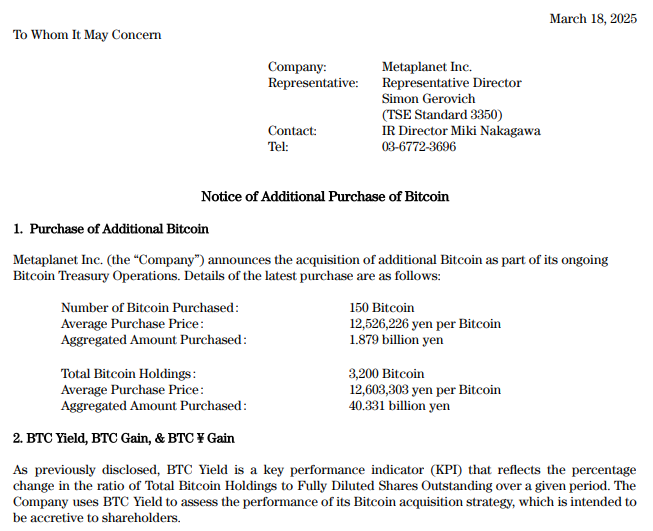

On Tuesday, Metaplanet disclosed acquiring 150 BTC at an average price of $83,508 per coin, bringing its total holdings to 3,200 BTC—valued at roughly $266 million. Yet, the firm isn’t stopping there.

In a bold financial maneuver, Metaplanet also raised 2 billion yen (about $13.3 million) through bond issuance on the same day to fund even more Bitcoin purchases.

Metaplanet’s strategy marks a growing trend among public companies: using traditional debt instruments to gain greater exposure to Bitcoin. While corporate treasuries have slowly added Bitcoin to their balance sheets, Metaplanet’s decision to issue bonds for further accumulation shows heightened conviction and risk tolerance.

According to CEO Simon Gerovich, the company is sticking firmly to its target: accumulating 10,000 BTC by the end of 2025 and 21,000 BTC by 2026.

If achieved, this would place Metaplanet among the largest corporate Bitcoin holders globally, joining the ranks of MicroStrategy and other early adopters who are betting big on crypto.

Stock Performance and Market Reactions

Despite the ambitious Bitcoin bet, Metaplanet’s stock closed slightly lower on Tuesday, down 0.49% at 4,030 yen. However, the longer-term performance tells a different story, shares are up 15.8% year-to-date and an astounding 1,819% over the past year, according to Yahoo Finance.

The broader Nikkei 225 index rose 1.2% the same day, underscoring a favorable market backdrop. Still, Metaplanet’s aggressive Bitcoin strategy remains the wildcard—investors seem torn between excitement over crypto potential and caution over increased financial risk.

Metaplanet’s relentless accumulation raises broader questions: Are more corporations ready to follow suit? Or is this a high-stakes gamble that could backfire if Bitcoin faces prolonged volatility?

The firm is clearly betting on Bitcoin as a strategic reserve asset, embracing the narrative that Bitcoin will outperform traditional assets over time. Its bond issuance signals confidence but also exposes the company to interest rate risk and market swings if Bitcoin underperforms.

Globally, a handful of firms are testing this model, but few have committed to such aggressive targets. With financial institutions and governments closely monitoring Bitcoin’s trajectory, Metaplanet’s success or failure could set a precedent.

The Road Ahead

Metaplanet’s clear roadmap sends a strong message: this is not a speculative play it’s a long-term strategy. The firm’s ability to leverage traditional finance tools like bonds could pave the way for more hybrid crypto-financial models in the corporate world.

Still, the journey is far from risk-free. The coming months will test whether Metaplanet can navigate Bitcoin’s price volatility, bond market dynamics, and investor scrutiny—all while keeping pace with its ambitious accumulation goals.

Metaplanet may emerge as a blueprint for publicly traded Bitcoin treasuries if it succeeds. If not, it will be a cautionary tale on the limits of mixing leverage with volatile assets.

One thing is clear—Metaplanet’s next move is one the crypto and financial world will be watching closely.