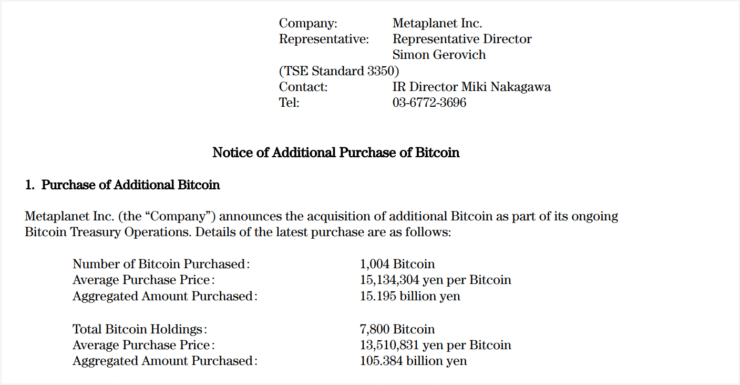

Japanese investment giant Metaplanet has deepened its Bitcoin treasury strategy with the acquisition of 1,004 BTC, marking its second-largest single purchase to date. The $104.6 million buy, announced on May 19, brings the company’s total holdings to 7,800 BTC—now valued at over $807 million based on current prices.

This latest move comes just a week after Metaplanet made headlines for its largest-ever crypto purchase: 1,241 BTC for $129 million on May 12. That earlier buy vaulted the firm past El Salvador’s national Bitcoin reserve, making Metaplanet one of the most aggressive institutional accumulators of BTC in the world.

The timing is also notable. The firm continues to expand its position as Bitcoin hovers within 3% of its all-time high, signaling a strong vote of confidence in the digital asset’s long-term value.

With this purchase, Metaplanet strengthens its lead as Asia’s largest corporate Bitcoin holder and joins the ranks of the top ten publicly traded firms globally in terms of BTC exposure. The company’s strategy reflects a growing institutional trend of viewing Bitcoin not just as a speculative asset, but as a core component of corporate treasury management.

Metaplanet Rises to Top 10 Corporate BTC Holders

Metaplanet is rapidly climbing the global leaderboard of corporate Bitcoin holders, already securing the top spot in Asia and ranking tenth worldwide among public firms, according to BiTBO data.

The Japanese investment firm has significantly accelerated its accumulation strategy in recent months. In May alone, Metaplanet acquired 2,800 BTC, building on four separate purchases in April totaling 794 BTC and six in March that added another 1,655 BTC. This sustained buying spree has pushed its total holdings to 7,800 BTC.

Financial metrics further highlight the firm’s aggressive positioning. Metaplanet reported a BTC yield of 95.6% in Q1, followed by a 47.8% yield so far in Q2—figures that represent the percentage increase in BTC per fully diluted share. This performance signals a deliberate push to increase shareholder exposure to Bitcoin at scale.

With just 301 more BTC, Metaplanet would surpass Galaxy Digital Holdings, which currently holds 8,100 BTC, moving into ninth place globally. Meanwhile, MicroStrategy—under Michael Saylor’s leadership—remains the undisputed leader with 568,840 BTC worth approximately $59 billion.

Saylor Hints at Another Bitcoin Purchase

Strategy Chairman Michael Saylor may be gearing up for another major Bitcoin purchase. In a recent post on X, Saylor shared a screenshot of the Saylor Tracker—a tool that monitors the firm’s BTC portfolio—alongside a cryptic caption: “Never short a man who buys orange ink by the barrel.”

Though not a formal announcement, the post has sparked speculation that Strategy could be preparing for another round of accumulation. The firm already leads all publicly traded companies in Bitcoin exposure, holding 568,840 BTC valued at roughly $59 billion.

According to data from BTC investment platform River, Strategy alone accounts for 77% of all corporate Bitcoin growth so far in 2025. River’s latest research, published May 12, highlights that corporations and businesses have become the largest net buyers of Bitcoin this year—surpassing even ETFs, governments, and retail participants.

With corporate adoption accelerating and Bitcoin trading near record highs, Saylor’s hints may signal yet another aggressive move in a year already dominated by institutional accumulation.

Quick Facts

- Metaplanet added 1,004 BTC on May 19 for $104.6 million, its second-largest single purchase to date.

- The company now holds 7,800 BTC valued at over $807 million.

- In 2025 alone, Metaplanet has acquired 2,800 BTC in May and over 2,400 BTC across March and April.

- Michael Saylor’s Strategy remains the leader in corporate Bitcoin ownership with 568,840 BTC.