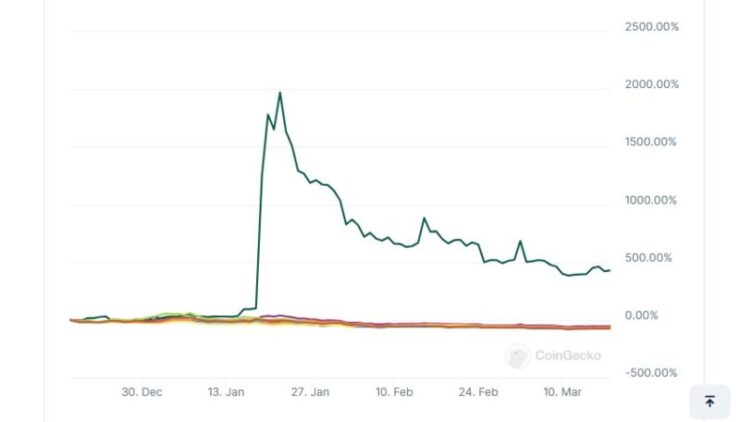

The hype-driven memecoin sector has taken a brutal hit this week, with the Memecoin Index plunging nearly 90% from its recent highs. As broader crypto markets pull back, meme tokens—known for their extreme volatility and speculative appeal—are bearing the brunt of investor sell-offs.

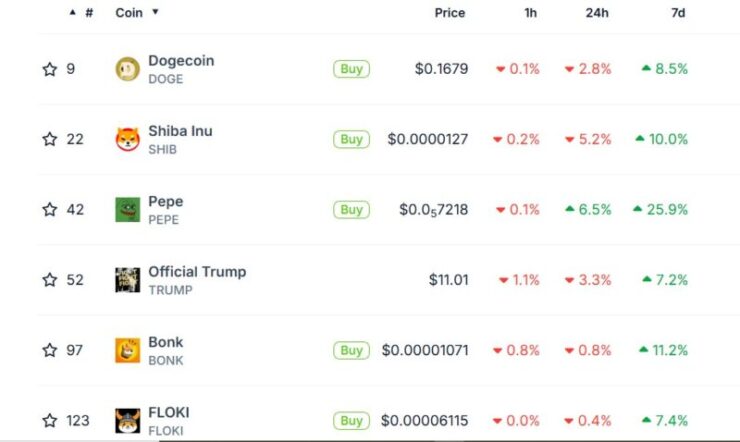

The top crypto market Memecoin have seen their combined value drop from record highs to less than one-tenth of the obtained peak within just a few weeks. This collective includes the performance of some of the most popular memecoins in the market, including Dogecoin, Shiba Inu, $TRUMP, $MELANIA, PEPE, FLOKI, and BONK.

These tokens had previously experienced explosive gains, fueled by renewed retail enthusiasm, social media hype, and the broader uptrend in the crypto market. However, as market conditions shifted and profit-taking set in, the memecoin sector’s lack of fundamentals made it particularly vulnerable to sharp corrections.

Analysts point to declining trading volumes and waning retail interest as key factors behind the index’s dramatic decline. The risk-on appetite that had driven memecoin rallies appears to have cooled, with traders shifting focus toward more established cryptocurrencies or moving to the sidelines amid market uncertainty.

Speculative Nature of Memecoins

Memecoins have long been considered a speculative corner of the crypto market, heavily reliant on community sentiment, viral marketing, and celebrity endorsements rather than underlying utility or technological innovation.

While this formula has yielded massive short-term gains during bull cycles, it also leaves investors highly exposed when sentiment turns bearish. The recent downturn has reinforced the fragility of memecoins, as projects with limited real-world use cases are among the first to suffer in risk-off environments.

Despite their decline, some industry observers argue that memecoins will likely continue to play a role in crypto culture, albeit with heightened volatility and unpredictable price movements.

Broader Crypto Market Weakness Adds Pressure

The collapse of the Memecoin Index comes amid a wider retracement across the cryptocurrency landscape. Major assets like Bitcoin and Ethereum have struggled to maintain recent highs, with macroeconomic factors, regulatory uncertainty, and profit-taking weighing on overall market sentiment.

This broader downturn has amplified losses for high-beta assets like memecoins, which tend to experience exaggerated price swings compared to more established digital assets. The current environment has prompted traders to become increasingly cautious, with many opting to rotate capital into less speculative holdings or stablecoins until clearer market signals emerge.

This phenomenon is not unique to crypto. In traditional markets, similar rotations occur when economic conditions tighten or investor risk tolerance diminishes. As regulatory developments and macro pressures continue to shape the digital asset landscape, market participants may increasingly prioritize projects with clear utility, strong development teams, and sustainable ecosystems over meme-driven hype cycles.

Quick Facts:

- The Memecoin performance Index has dropped nearly 90% from its recent highs.

- Popular memecoins like DOGE, SHIB, PEPE, TRUMP, FLOKI, and BONK have suffered significant losses.

- Declining retail interest and broader crypto market weakness are key drivers behind the plunge.

- The trend reflects shifting risk appetite as investors move away from speculative assets.