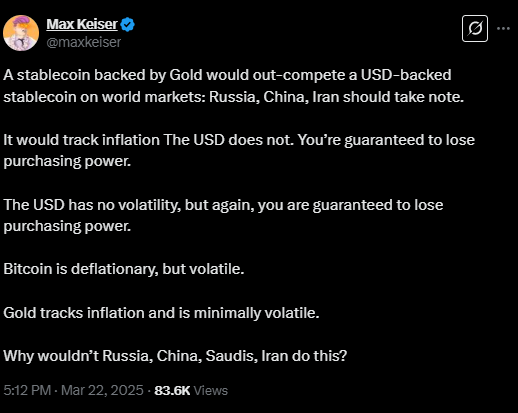

Bitcoin maximalist Max Keiser has made a bold prediction, gold-backed stablecoins could soon eclipse U.S. dollar-pegged alternatives on the global stage. With mounting inflation concerns and geopolitical rifts, Keiser argues that trust in the U.S. dollar is fading, setting the stage for gold to reclaim its historic role as the world’s most reliable store of value.

If his forecast holds, the rise of gold-backed digital assets could reshape the stablecoin market and challenge U.S. financial dominance.

Keiser’s case is simple: nations adversarial to the U.S., like Russia, China, and Iran, will never fully embrace dollar-based stablecoins. Instead, these countries are likely to counter with gold-backed alternatives leveraging their vast gold reserves to bypass dollar influence.

“Russia, China, and Iran are not going to accept a U.S. dollar stablecoin. I predict they will counter the USD stablecoin with a gold one,” Keiser declared. He estimates combined Chinese and Russian gold holdings could exceed 50,000 tonnes — a staggering figure that would provide ample backing for digital gold tokens.

Tether’s Alloy (aUSD₮) — A Glimpse Into Gold-Backed Stablecoins

The race toward gold-pegged assets isn’t theoretical. In June 2024, stablecoin giant Tether launched Alloy (aUSD₮), backed by its tokenized gold product XAU₮. Tether’s move signals a growing market demand for stable digital assets rooted in physical commodities rather than fiat promises.

Former VanEck executive Gabor Gurbacs was quick to note the irony — gold-backed stablecoins may now fulfill the original promise of the U.S. dollar itself, before the U.S. abandoned the gold standard in 1971.

“Tether Gold is what the dollar used to be,” Gurbacs argued, pointing out that XAU₮ outperformed the broader crypto market this year, gaining 15.7% year-to-date.

Washington, however, sees a different future. At the White House Crypto Summit this March, Treasury Secretary Scott Bessent reaffirmed the U.S. commitment to using dollar-backed stablecoins as a tool to defend the greenback’s global dominance.

U.S. lawmakers are actively drafting legislation, including the Stable Act of 2025 and the GENIUS Stablecoin Bill, to cement a regulatory framework that supports tokenized fiat assets while keeping dollar-pegged coins at the center of global finance.

The Bigger Picture — A Global Battle for Stablecoin Dominance

Keiser’s prediction adds a new layer to an already intensifying debate about the future of stablecoins. As emerging economies seek alternatives to the dollar, gold-backed stablecoins offer a politically neutral, inflation-resistant option, potentially disrupting U.S. strategies to extend dollar power through digital assets.

If gold-backed tokens gain momentum, they could create a parallel stablecoin market, one aligned with commodities rather than fiat, forcing global regulators to rethink digital asset frameworks.

The Takeaway

As inflation fears linger and geopolitical divides deepen, gold’s timeless appeal as a safe-haven asset is resurfacing — this time in tokenized form. Whether Keiser’s prediction materializes or not, one thing is clear: the stablecoin race is no longer just about the dollar.

Gold-backed stablecoins are entering the arena, and their rise could mark the beginning of a new era in global finance, where digital gold competes head-to-head with tokenized dollars.