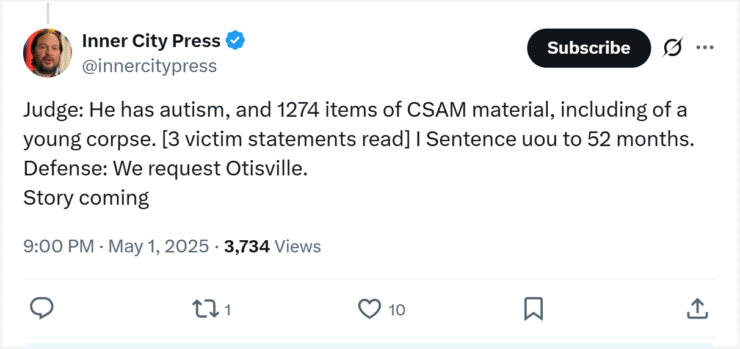

Avraham Eisenberg, known for orchestrating the $110 million exploit of Mango Markets, has been sentenced to 52 months in prison—but for an unrelated crime. The sentence, handed down on May 1 by a federal judge in the Southern District of New York, follows Eisenberg’s conviction for possessing child sexual abuse material (CSAM).

This sentencing comes nearly a year after Eisenberg was also indicted for the 2022 exploit of Mango Markets, a decentralized exchange on the Solana blockchain. That case, involving charges of fraud and market manipulation, remains unresolved and is still under judicial review.

While both cases were initially expected to be addressed in a single proceeding, the court has proceeded only with the CSAM sentencing for now. Eisenberg’s crypto-related sentencing has been delayed, adding further complexity to one of DeFi’s most closely watched legal battles.

His legal entanglements are notable not just for their disturbing nature, but also for their potential to set precedent in decentralized finance (DeFi)—particularly around exploit-based trading tactics and smart contract vulnerabilities.

Eisenberg Defended $100M Exploit as ‘Legal Trading’

The October 2022 Mango Markets exploit stands as one of the most high-profile incidents in the history of decentralized finance. The attack involved manipulating price oracles, allowing Eisenberg to drain nearly all liquidity from the exchange and send the MNGO token crashing more than 50% in a day.

Following the exploit, Mango suspended trading and launched emergency stabilization efforts.

Eisenberg later publicly identified himself as the attacker, claiming his actions were a legal use of the platform’s smart contracts. He described the incident as “legal open-market trading”, not a hack, and noted he had entered into negotiations with Mango DAO, agreeing to return a portion of the funds in exchange for immunity from prosecution. That deal, however, was never honored by law enforcement.

Jury Rejects Defense, Convicts Eisenberg on Fraud Charges

Eisenberg was arrested in Puerto Rico in December 2022 and charged with commodities fraud, wire fraud, and market manipulation by the FBI and federal prosecutors.

Despite claims by his defense team that the exploit was a lawful trading strategy, a jury in April 2024 found Eisenberg guilty on all major counts, rejecting arguments that his actions were within the bounds of DeFi protocol logic.

Eisenberg’s attorneys later filed a motion for acquittal, arguing the jury misunderstood how smart contracts function. Prosecutors strongly opposed the motion, stating that the jury had correctly interpreted the exploit as a calculated and fraudulent scheme.

With sentencing in the Mango Markets case still pending, the legal outcome may shape how U.S. courts approach trading activity on decentralized platforms, especially where exploits blur the line between code and crime.

Quick Facts

- Avraham Eisenberg sentenced to 52 months for possession of child sexual abuse material (CSAM).

- The CSAM conviction is separate from his conviction for the $110 million Mango Markets exploit.

- A federal judge is considering retrial motions for the Mango Markets charges.

- The case could set precedent for applying traditional fraud laws to DeFi exploits.