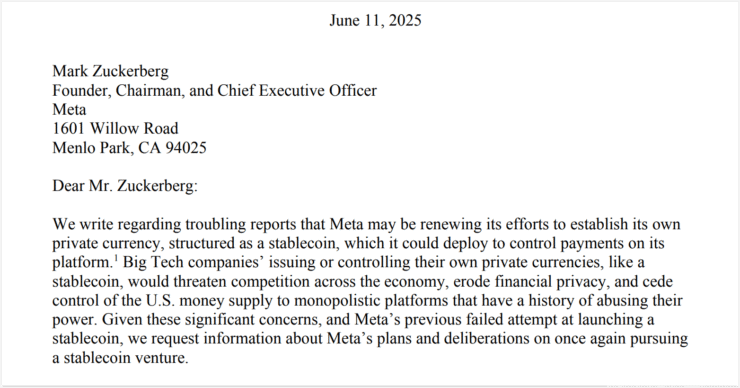

As the U.S. Senate inches closer to a decisive vote on the GENIUS Act—legislation that could reshape the regulatory landscape for payment stablecoins—Senators Elizabeth Warren and Richard Blumenthal have raised pointed questions about Meta’s potential reentry into the stablecoin market. In a formal letter addressed to CEO Mark Zuckerberg on Wednesday, the senators demanded clarity on whether Meta intends to revive a stablecoin project and whether it played any role in influencing the legislation’s development.

The lawmakers stressed that Meta’s immense size and influence make it imperative for Congress and the public to understand the full scope of the company’s digital currency plans. They requested specific disclosures on any companies Meta may have collaborated with this year regarding stablecoin technology, and any communications with lawmakers that may have impacted the language or direction of the GENIUS Act.

The inquiry reflects growing bipartisan concern over the intersection of Big Tech and digital finance, especially as the regulatory environment for stablecoins becomes more defined. With the GENIUS Act likely to set the tone for future oversight, Meta’s potential return—following the collapse of its earlier Diem project—has reignited debate over how much influence tech giants should wield in shaping the rules that could govern their own platforms.

Senators Say GENIUS Act Could Let Meta Skirt Rules

In their detailed letter to Zuckerberg, the senators cited Meta’s controversial history with its failed Libra and Diem stablecoin projects, which were abandoned following global regulatory backlash.

Central to their concern is the possibility that President Donald Trump could issue a waiver exempting Meta from certain GENIUS Act requirements. Such a move, they argue, would allow the company to operate under looser oversight than other stablecoin issuers, raising serious data privacy and consumer protection risks.

“If Meta were to control its own stablecoin,” the senators wrote,

“The company could further pry into consumers’ transactions and commercial activity.”

The letter arrives amid reports that Meta is again exploring stablecoin integrations across its platforms—including Facebook, Instagram, Threads, Messenger, and WhatsApp.

While it remains unclear whether Meta plans to issue a new digital token or rely on existing stablecoins like USDC or USDT, public scrutiny is mounting. Meta’s communications director, Andy Stone, previously stated on May 8 that “there is no Meta stablecoin,” but lawmakers remain unconvinced as the company’s digital payments ambitions continue to evolve.

GENIUS Act Clears Senate Hurdle Despite Political Concerns

The GENIUS Act moved one step closer to becoming law on Wednesday after 68 U.S. senators voted to invoke cloture, paving the way for floor debate, amendments, and a final Senate vote in the coming days. The bipartisan support signals strong momentum for the bill, which aims to establish a federal framework for regulating payment stablecoins.

Several Democrats joined Republicans in backing the motion, highlighting a growing consensus on the need for digital asset oversight. However, not all lawmakers were on board. Senator Elizabeth Warren voiced concern over the political implications of the bill—specifically pointing to President Donald Trump’s links to the crypto platform World Liberty Financial, which is reportedly backed by members of his family.

Warren warned that if the legislation passes without tighter safeguards, it could enable politically connected firms to gain preferential treatment in the emerging stablecoin market. Despite these objections, the Senate’s strong support indicates that digital payment regulation is rapidly becoming a bipartisan priority in Washington.

Quick Facts

- Senators Warren and Blumenthal asked Meta to disclose stablecoin plans.

- Concerns center on Meta’s influence over GENIUS Act language.

- Lawmakers worry Trump could exempt Meta via presidential waiver.

- GENIUS Act passed cloture in the Senate with a 68–32 vote.

- The bill would create a federal framework for stablecoin regulation.