Kraken, one of the largest cryptocurrency exchanges in the United States, is preparing for an initial public offering (IPO) in early 2026, according to multiple reports. The San Francisco-based company, officially known as Payward Inc., is positioning itself for a public listing after regulatory barriers that once hindered its plans have eased.

If the offering proceeds as planned, Kraken would become only the second publicly traded U.S.-based crypto exchange, following Coinbase’s landmark IPO in April 2021.

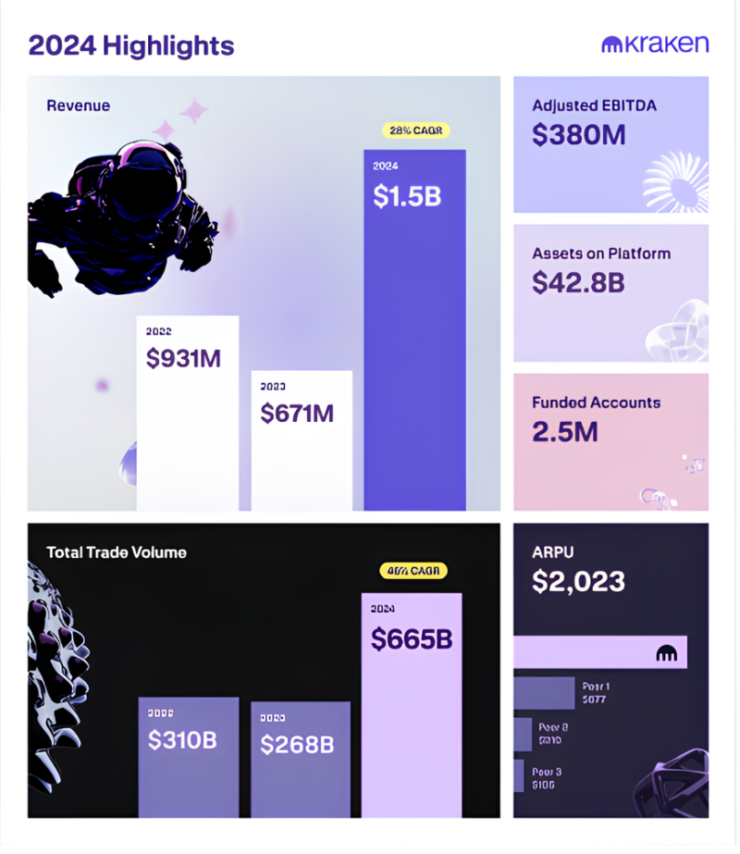

While a specific timeline has not been confirmed, a Kraken spokesperson told Decrypt that going public remains a key part of the company’s long-term strategy. “We recently disclosed 2024 financial highlights to be more transparent about our business, which is something we started by being first to publish proof of reserves, and we’re going to continue to prioritize going forward,” the spokesperson said. “We’ll pursue public markets as it makes sense for our clients, our partners and shareholders.”

SEC Drops Lawsuit Against Kraken

Kraken’s renewed IPO ambitions follow a significant regulatory shift. In March 2025, the U.S. Securities and Exchange Commission (SEC) agreed to drop its lawsuit against the exchange, which had been ongoing since November 2023. The suit accused Kraken of operating as an unregistered securities exchange, broker, and dealer, and of commingling customer assets with company funds.

The lawsuit had been a major obstacle for Kraken’s public listing plans. Under former SEC Chair Gary Gensler, the agency took a strict stance against crypto firms, pursuing multiple enforcement actions. Kraken fought the allegations, and after the election of President Donald Trump, the SEC began rolling back its aggressive regulatory approach. The case against Kraken was dismissed with no admission of wrongdoing, no penalties, and no operational changes.

This move signals a broader policy shift under the Trump administration. Since taking office, the new administration has dismissed several SEC investigations into crypto firms. President Trump has also scheduled meetings with over two dozen industry leaders, including Kraken’s Co-Chief Executive Officer Arjun Sethi, to discuss the future of digital assets regulation.

Financial Growth and Market Position

KrakenKraken’s IPO plans coincide with significant financial growth. In 2024, the company reported a revenue of $1.5 billion—more than double the previous year’s total. Adjusted earnings reached $380 million. By comparison, Coinbase, the largest U.S. crypto exchange, generated $6.6 billion in revenue last year.

Kraken ranks as the tenth-largest cryptocurrency exchange globally by trading volume, according to CoinMarketCap. The company has been expanding internationally, rolling out new services, and developing additional financial products to strengthen its market position. Despite its success, Kraken has raised only $27 million in primary capital since its founding in 2011.

Kraken is one of several crypto firms eyeing the public markets. Circle, the issuer of the USDC stablecoin, is reportedly preparing for a listing, while digital asset custodian BitGo and exchanges such as Gemini and Bullish are also considering IPOs. The improving regulatory climate in the U.S. is a key factor driving these moves.

Kraken originally planned to go public as early as 2022 but postponed its efforts due to increased regulatory scrutiny. With the SEC stepping back from aggressive enforcement actions, the company sees an opportunity to revisit its IPO ambitions.

While no official filings have been made, sources familiar with Kraken’s plans suggest the company aims for a first-quarter 2026 listing. The final decision will depend on market conditions and investor appetite in the coming months.