Kraken has officially secured restricted dealer registration from the Ontario Securities Commission (OSC), which cements the exchange’s ability to operate under Canada’s tightening crypto regulatory regime. The approval follows years of preparation, during which Kraken upgraded its compliance infrastructure and worked closely with regulators to meet enhanced oversight requirements.

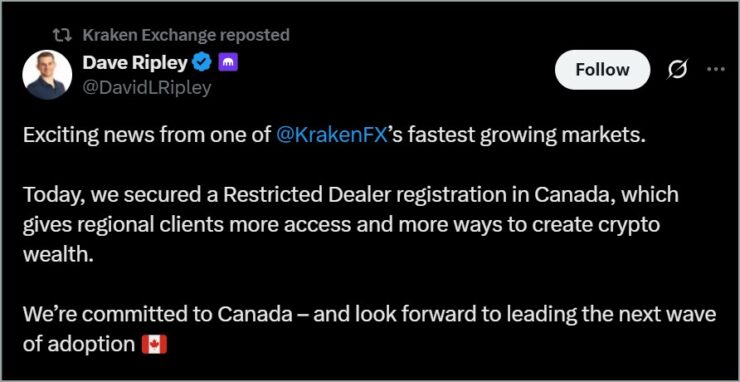

This designation disclosed by CEO Dave Ripley on X allows the exchange to continue offering its crypto services to Canadian users, even as other firms—such as Gemini—have exited the market citing regulatory pressures.

The development underscores a broader trend in Canada’s crypto sector, where regulators take a more hands-on approach in the wake of global scrutiny. With Kraken’s registration now secured, the exchange joins a small group of platforms—including Coinbase—that are positioning themselves as compliant players in what is increasingly becoming a regulated digital asset market.

Kraken Taps Fintech Veteran to Lead North American Push

Kraken has appointed fintech and operations specialist Cynthia Del Pozo as its new General Manager for North America, as the exchange deepens its commitment to the Canadian market following its restricted dealer registration approval. Del Pozo will be responsible for overseeing strategic growth, navigating regulatory relationships, and expanding business operations across both Canada and the U.S.

Her appointment comes as Kraken strengthens its foothold in Canada with user-focused upgrades, including the rollout of free Interac e-Transfer deposits for local customers—an effort to make onboarding more seamless. According to the exchange, Kraken’s Canadian user base and staff count have both doubled in the last two years, with the platform now managing more than $2 billion CAD in client assets.

“Canada is at a turning point for crypto adoption, with a growing number of investors and institutions recognizing digital assets as a vital part of the financial future,” Del Pozo said in the announcement, adding:

“I’m thrilled to join Kraken’s mission at this critical moment, and to lead our expansion efforts, ensuring we continue to serve our clients long-term with innovative and compliant products.”

Kraken’s Canadian License Carries Unique Regulatory Conditions

Kraken’s newly secured restricted dealer license in Canada has regulatory nuances that differentiate it from other categories like investment dealers or fund managers. As explained by the Canadian Securities Administrators (CSA), restricted dealer status is granted to firms that fall outside standard classifications, often accompanied by tailored requirements specific to their business model.

This designation is part of a broader framework to ensure investor protection while allowing innovative financial services to operate under close regulatory supervision. Kraken’s successful registration under this category allows it to continue serving Canadian users legally while adhering to enhanced oversight standards.

The milestone also marks a full-circle moment for the exchange, which first entered the Canadian market through the acquisition of local exchange CaVirtEx in 2016. Kraken’s early presence in Canada helped lay the groundwork for its current expansion under a more formalized and regulated structure.

These recent developments in the Canadian crypto market—including Kraken’s milestone win and Gemini’s exit—signify a broader trend of increased regulatory scrutiny in the global cryptocurrency sector. Exchanges that proactively engage with regulators and prioritize compliance are better positioned to navigate this complex landscape, fostering trust and stability within the market.

Quick Facts

- Kraken has been registered as a restricted dealer by the Ontario Securities Commission, allowing it to comply with Canadian regulations.

- Cynthia Del Pozo has been appointed as Kraken’s General Manager for North America to lead expansion efforts.

- Kraken now offers free Interac e-Transfer deposits for Canadian users to enhance accessibility.

- The Canadian crypto market is experiencing significant changes, with some exchanges exiting and others securing compliance registrations.