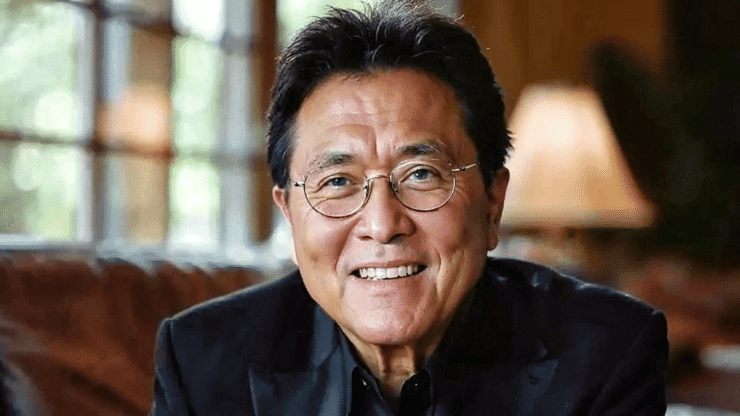

Robert Kiyosaki, author of Rich Dad Poor Dad, is once again urging the public to buy Bitcoin—calling it the “easiest way to get rich” amid global economic instability. In a post shared late Sunday, he expressed disbelief that more people haven’t taken the opportunity to invest.

“I cannot believe how easy Bitcoin has made getting rich…so easy. Why everyone is not buying and holding Bitcoin is beyond me.” Kiyosaki wrote.

He encouraged followers to consider even small purchases, saying that 0.01 BTC could become “priceless in two years.”

His comments came as Bitcoin rebounded to around $109,600 following the U.S. decision to delay proposed 50% tariffs on EU imports. The announcement helped stabilize broader markets, including equities and crypto.

Kiyosaki has long advocated for Bitcoin, gold, and silver as hedges against inflation and declining confidence in fiat currencies. His latest remarks add to a growing narrative that positions Bitcoin as not just an investment—but a safeguard against systemic financial risk.

Raises Bitcoin Target to $350K by 2025

Doubling down on his bullish forecast, Kiyosaki revised his earlier $300,000 price target to $350,000 by the end of 2025. He warned of continued weakness in the U.S. dollar and framed Bitcoin as a lifeline amid what he describes as a deteriorating monetary system.

Calling this the “easiest time in history” to gain financial independence, Kiyosaki advised followers to look past short-term volatility and focus on Bitcoin’s long-term potential. He also recommended tuning into voices like Michael Saylor, Raoul Pal, and Anthony Pompliano to better understand Bitcoin’s trajectory.

While some analysts consider his views overly optimistic, Kiyosaki’s rhetoric reflects a broader push toward hard assets as inflation, rate policy, and geopolitical risks reshape the financial landscape.

Meanwhile, corporate giant Strategy (formerly MicroStrategy) continues its aggressive Bitcoin accumulation. The company added $764 million worth of BTC last week, bringing total holdings to 576,000 BTC—now valued at over $64 billion.

The move reinforces Strategy’s conviction in Bitcoin as a core reserve asset, even as some experts urge caution.

Analysts Warn of Highs Without a Historical Guide

With Bitcoin entering all-time high territory, analysts note that price discovery may bring both steep rallies and sudden corrections. Arthur Azizov, founder of B2 Ventures, suggested Bitcoin could climb to $130,000 by late 2025 or early 2026—but warned that a pullback to $60,000 or even $50,000 remains possible.

“Now that Bitcoin has surpassed its previous highs, we’ve entered pure price discovery,” Azizov said. “It’s an exciting time, but also a risky one.”

The combination of rising institutional conviction and macro uncertainty continues to push Bitcoin into new territory—but the road ahead may remain volatile.

Quick Facts

- Robert Kiyosaki urged followers to buy even 0.01 BTC.

- He raised his 2025 Bitcoin target from $300K to $350K.

- Strategy added $764M in Bitcoin, now holds 576,000 BTC.

- Bitcoin is trading near $109,600 after tariff delay relief.

- Analysts warn of volatility as Bitcoin enters price discovery.