The KIP Protocol, a Web3 company specializing in AI-powered payment infrastructure, has disclosed its involvement in Project Libertad, a financial initiative promoted by Argentine President Javier Milei. The project gained widespread attention following the launch of its LIBRA token, which collapsed by over 95% within hours of trading.

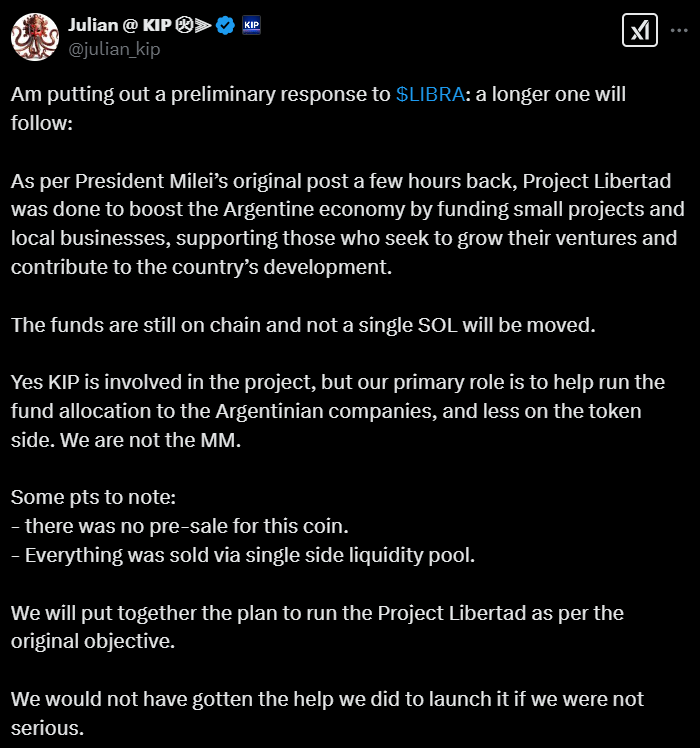

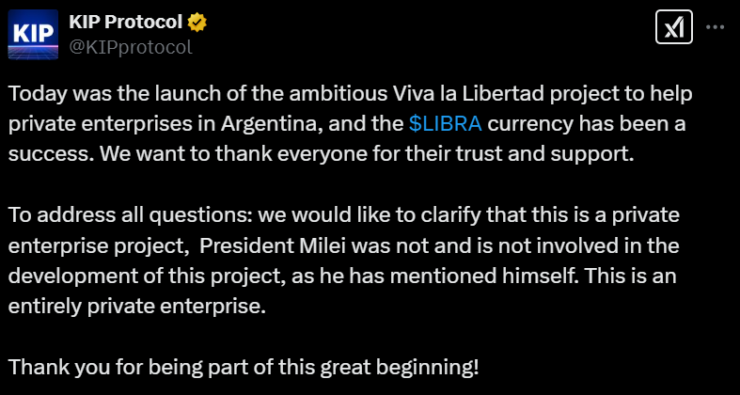

Despite concerns over the token’s legitimacy, KIP Protocol’s CEO and co-founder, Julian Peh, clarified that the company was only involved in distributing funds to local businesses in Argentina and had no direct role in creating or managing the LIBRA token itself.

KIP Protocol Distances Itself from LIBRA’s Market Collapse

In a Feb. 15 X Space, Peh stated that KIP Protocol acted as a technology consultant, helping facilitate payments and fund distribution for businesses. However, he emphasized that the company did not create the token, act as a market maker, or profit from its sale.

Peh refrained from providing details on other entities involved in LIBRA’s launch, leaving many questions unanswered about the token’s origins and financial backers.

In a separate social media post, Peh reiterated that Project Libertad is still operational and that KIP Protocol remains committed to supporting small businesses in Argentina as originally promised.

LIBRA Token Gains Momentum Before Crashing

The LIBRA token initially surged in popularity after President Milei pinned a now-deleted post on his X (formerly Twitter) profile, endorsing the project as a potential catalyst for economic growth and startup development in Argentina.

However, soon after the post was removed, the token’s value plummeted by over 95%, raising alarms among investors and market analysts. The rapid downturn sparked speculation about whether the project had government backing or if it was an opportunistic launch capitalizing on political endorsements.

Was LIBRA Rushed? Analysts Raise Red Flags

Financial experts and market analysts have flagged several concerns regarding the legitimacy of Viva La Libertad, the initiative backing the LIBRA token.

- Dubious Website Setup: Analysts at The Kobeissi Letter, a popular financial newsletter, discovered that the project’s website was registered just hours before launch and was only valid for a one-year period—a sign that the initiative may have been hastily assembled.

- Google Forms for Fund Applications: Investors also raised eyebrows over the project’s funding process, which relied on a basic Google Form for businesses to apply for financial support.

- Lack of Transparency: The website lacks public ownership details, and several domain restrictions prevent further scrutiny, fueling concerns over who controls the token’s reserves.

LIBRA’s Tokenomics Under Scrutiny

On-chain analytics firm Bubblemaps further exposed critical flaws in LIBRA’s token distribution:

- 50% of the token supply is held in a single wallet – meaning a single entity could significantly impact the token’s market.

- 82% of the total supply is currently unlocked, making it vulnerable to a potential sell-off at any time.

Bubblemaps compared LIBRA’s high-risk structure to former U.S. President Donald Trump’s memecoin, TRUMP, which at least implemented a token lock-up period to control liquidity.

Despite TRUMP’s lock-up, the token’s launch drew political and legal scrutiny, with critics arguing that political tokens could be used as an avenue for bribery or illicit fundraising.

Milei Withdraws Support, Distancing Himself from the Project

As concerns mounted, President Milei retracted his endorsement of Viva La Libertad and denied having direct involvement in the token’s launch. This fueled further skepticism, as his initial post played a key role in driving early investor interest.

Many investors initially suspected Milei’s social media account had been hacked, but after multiple Argentine politicians reposted the announcement, some believed the project had official backing leading to increased speculation and market activity.

What This Means for Argentina’s Crypto Landscape

The LIBRA debacle underscores the regulatory uncertainty surrounding politically endorsed tokens and raises critical questions about Argentina’s blockchain adoption strategy.

Key Takeaways:

- KIP Protocol maintains that it only provided tech consulting and did not create the token.

- LIBRA’s sudden collapse raises concerns about transparency and governance.

- Argentina’s regulatory stance on crypto remains unclear, despite Milei’s pro-crypto reputation.

Final Thoughts

With KIP Protocol reaffirming its commitment to Project Libertad, the fate of Argentina’s blockchain-powered financial initiatives remains uncertain. While crypto adoption in emerging markets is accelerating, incidents like the LIBRA token crash highlight the importance of regulatory clarity, investor protections, and project transparency.

As Argentina navigates its evolving crypto landscape, it remains to be seen whether Milei’s administration will push for stronger oversight or if the country will continue to embrace blockchain innovation despite the risks.