Prediction markets are flashing red, and for good reason. After former President Donald Trump’s sweeping tariff order on April 2, traders on Kalshi now peg the odds of a U.S. recession in 2025 at a stunning 64%, up from 34% just weeks ago. On Polymarket, sentiment is nearly identical, sitting at 63%.

What changed in a matter of days? A jarring combination of economic nationalism, a plunging stock market, and whispers of a politically engineered downturn.

Trump’s executive order didn’t just raise eyebrows, it rocked global markets. The policy imposed a baseline 10% tariff on all imports, with adjustable “reciprocal” tariffs targeting nations that already tax U.S. goods.

Within days, more than $5 trillion in shareholder value evaporated as investors scrambled to digest the implications. The S&P 500 plunged, volatility spiked, and capital began fleeing risk assets across the board—including crypto.

Market analysts warn that this could mark the beginning of a long and painful trade war, one that not only stifles U.S. growth but reverberates through already fragile global supply chains.

Recession Odds: A Self-Fulfilling Prophecy?

Kalshi and Polymarket use a widely accepted benchmark for recessions: two consecutive quarters of negative GDP growth. With Q2 already off to a rocky start, the odds have almost doubled since mid-March.

But the speed of the shift raises another possibility, is this downturn being engineered?

Asset manager Anthony Pompliano stirred controversy this week, suggesting that Trump may be intentionally triggering a recession. His rationale? Lower interest rates.

As the 10-year Treasury yield dropped from 4.66% in January to 4.00% by April 5, Pompliano claimed this was no coincidence. Instead, he believes Trump is trying to force the Federal Reserve’s hand.

“Crashing markets gives political cover to slash rates,” he argued.

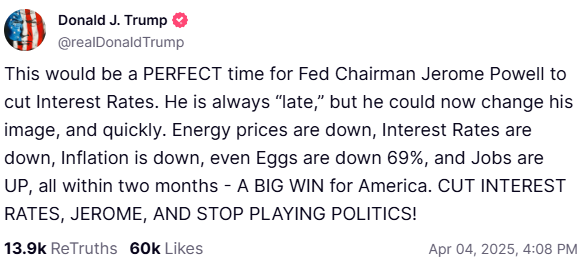

Supporting that claim, Trump took to Truth Social on April 4, urging Fed Chairman Jerome Powell to act:

“This would be a perfect time for Powell to cut interest rates.”

Global Ramifications: The Next Domino to Fall

Markets outside the U.S. aren’t immune. Europe, already teetering under stagnant growth, faces additional headwinds if U.S. tariffs hit European exporters. Emerging markets, heavily dependent on global trade, may suffer currency devaluations and capital flight.

Cryptocurrency markets, often seen as safe havens, are also feeling the pressure. Bitcoin and Ethereum have both slumped as risk sentiment evaporates.

If the trade war escalates, expect global GDP forecasts to be revised downward, pushing central banks across the world toward emergency measures.

Despite the chaos, Trump remains optimistic. On April 3, he dismissed the sell-off as a temporary adjustment, predicting the markets will “boom” once the tariffs rebalance trade relationships.

But optimism alone doesn’t calm investor panic. History shows trade wars rarely end in quick wins—and they almost always leave long-term scars.

A Crossroads for Policy and Markets

The coming months will be pivotal. If Q2 GDP shows contraction and markets continue their decline, recession calls may become a reality, not just a prediction market bet.

The Fed will face immense pressure to cut rates, while global investors will look for safer havens and more stable leadership.

This isn’t just about tariffs anymore. It’s about trust, strategy, and the future direction of U.S. economic policy.