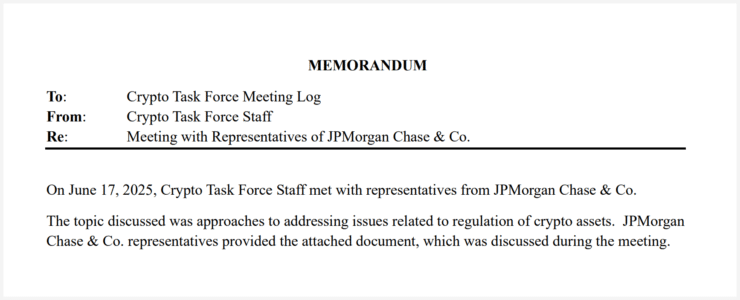

JPMorgan is inching closer to bringing Wall Street infrastructure onto public blockchains. In a recent closed-door meeting, senior JPMorgan executives met with the SEC’s Crypto Task Force to examine how core capital markets functions—such as repurchase agreements and securities trading—might operate on-chain.

According to a meeting memo released Tuesday, discussions focused on how existing financial architecture could evolve, the potential regulatory friction, and where risks and opportunities may lie.

The meeting also included a review of JPMorgan’s current crypto involvement. The bank highlighted its blockchain-based platforms used for short-term lending agreements and digital debt servicing, signaling that its “Digital Financing” and “Digital Debt Services” arms are already testing blockchain rails in practical settings.

Crucially, the conversation explored how JPMorgan could gain a competitive edge as financial giants race to integrate blockchain infrastructure. From faster settlements to tokenized assets, the bank is clearly positioning itself at the frontier of a rapidly transforming financial system—one that may no longer be tethered to legacy rails.

JPMorgan Taps Top Executives for SEC Blockchain Talks

JPMorgan’s recent engagement with U.S. regulators on the future of on-chain finance featured a high-profile delegation and coincided with its latest blockchain pilot.

The meeting, held with the SEC’s Crypto Task Force, included three of JPMorgan’s senior digital asset leaders: Scott Lucas, head of markets for digital assets; Justin Cohen, global head of equity derivatives development; and Aaron Iovine, who oversees global digital asset regulatory policy. Their presence underscored the strategic importance of blockchain in the bank’s future roadmap.

Just as regulatory discussions were underway, JPMorgan launched a pilot for its deposit token, JPMD, on Coinbase’s Layer 2 blockchain, Base. Initially limited to institutional partners, the token is being tested for use in transactions and settlements, with plans to expand access upon completion of the pilot in the coming months.

In tandem, the firm also filed a trademark for JPMD, detailing potential applications ranging from digital payments and crypto trading to blockchain-based fund transfers—further signaling its serious push into digital asset infrastructure.

JPMorgan Debunks Stablecoins Rumours, Backs Deposit Token Strategy

Despite recent trademark activity fueling rumors of an incoming stablecoin, JPMorgan executives are making it clear: a stablecoin isn’t on the agenda—at least not yet.

Speaking to Bloomberg, Naveen Mallela, a senior figure at Kinexys, JPMorgan’s blockchain-focused unit, clarified that the bank’s focus remains on deposit tokens rather than launching a traditional stablecoin. Mallela emphasized that deposit tokens offer a more robust and scalable framework for institutional use, pointing to the limitations of stablecoins, especially those backed on a fractional reserve basis.

Unlike stablecoins, which mimic fiat currency and are usually collateralized by a basket of cash or equivalents, deposit tokens are tied directly to actual customer deposits within regulated banks. This makes them inherently safer and more compliant with the existing financial system, according to JPMorgan’s positioning.

Quick Facts

- JPMorgan met with the SEC to discuss blockchain-based capital markets.

- The firm is piloting a deposit token, JPMD, on Coinbase’s Base chain.

- Executives say deposit tokens are safer than stablecoins for institutions.

- A new JPMD trademark hints at broader blockchain finance ambitions.