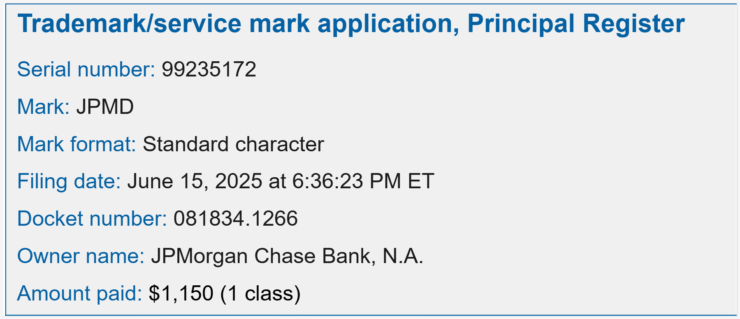

JPMorgan Chase has filed a new trademark application for the term “JPMD,” signaling a potential expansion of its digital asset footprint. The filing with the U.S. Patent and Trademark Office outlines a broad range of crypto-related services, including asset trading, exchange, custody, clearing, and payment processing.

Although the filing doesn’t directly reference a stablecoin, the comprehensive scope of services described has fueled industry speculation that JPMorgan could be preparing to roll out a more public-facing digital payment solution. Such a move would build on the bank’s existing infrastructure, including its JPM Coin, which is already used for institutional settlements.

The “JPMD” mark could represent a shift from internal blockchain systems to more consumer-oriented products, aligning JPMorgan with growing demand for crypto-native financial tools. If implemented, the project would strengthen the bank’s position at the convergence of traditional finance and tokenized payments—just as regulatory momentum builds in Washington.

Stablecoin Signals Grow as JPM Builds on Kinexy

While the “JPMD” trademark avoids mentioning stablecoins directly, many see it as a logical continuation of JPMorgan’s blockchain roadmap. A May 22 report by The Wall Street Journal revealed that JPMorgan, Bank of America, and Wells Fargo are exploring a joint stablecoin initiative. The goal is to rival crypto-native issuers by offering trusted, bank-backed payment alternatives for domestic and cross-border transactions.

If “JPMD” is linked to this initiative, it could mark a pivot toward issuing tokenized assets for broader retail and commercial use—not just interbank settlements. JPMorgan has already made strides through Kinexy (formerly Onyx), its blockchain-based network that has processed more than $1.5 trillion in tokenized transfers via JPM Coin.

JPM Coin, which is pegged 1:1 to fiat currencies such as the U.S. dollar, British pound, and euro, has made JPMorgan a major player in institutional blockchain adoption. And despite CEO Jamie Dimon’s continued criticism of Bitcoin, the bank remains one of the most active in developing regulated crypto infrastructure.

Senate Advances Stablecoin Bill as Banks Eye Entry

The timing of JPMorgan’s trademark filing coincides with major legislative movement in Washington. The U.S. Senate recently voted 68–30 to invoke cloture on the GENIUS Act (Guiding and Establishing National Innovation for U.S. Stablecoins), clearing the path for full debate and a final vote.

The bipartisan bill would establish a regulatory framework for stablecoin issuance and operations across the country, with support from both major parties and several high-profile Democrats. If passed, the bill will go to President Donald Trump for approval.

The legislation comes as the global stablecoin market reaches a $251 billion capitalization, led by Tether with $156.3 billion and Circle’s USDC with $61.3 billion, per DeFiLlama. As traditional banks like JPMorgan explore entry into the space, the GENIUS Act may provide the clarity needed to unlock institutional-grade products and rein in decentralized risks.

Quick Facts

- JPMorgan has filed to trademark “JPMD,” describing a range of crypto-related services including custody, payments, and clearing.

- Though stablecoins aren’t mentioned, the filing coincides with a reported initiative involving JPMorgan, Bank of America, and Wells Fargo to create a joint bank-backed digital currency.

- JPM Coin has already facilitated over $1.5 trillion in blockchain-based settlements via JPMorgan’s Kinexy network, offering a glimpse into its potential stablecoin infrastructure.

- The U.S. Senate is advancing the GENIUS Act to regulate stablecoins, a move that could support the entrance of traditional banks into the digital payments arena.