The Federal Reserve is supposed to be independent and free from political influence. But in reality, it’s run by people—people who respond to pressure, especially when the stakes are high. And no one understands pressure better than Donald Trump.

Trump has spent decades building his image as the ultimate winner, the boss, the man in charge. He thrives on attention, recognition, and power. So when it comes to the economy, he also always wants to control the narrative.

Trump’s Strategy: Create Uncertainty, Then Take Credit

Right now, Trump is shaking the markets with uncertainty. He’s flip-flopping on trade deals, delaying resolutions on big global issues, and keeping investors on edge. Why? Because when markets drop, people panic. And when people panic, they look for solutions.

Trump then shifts the blame elsewhere—on Europe, on Mexico, Canada, on NATO. He tells the public that these countries and entities have taken advantage of the U.S. for decades and that he’s the one fixing it. Meanwhile, the market continues to react negatively to all the instability.

The Fed Under Pressure

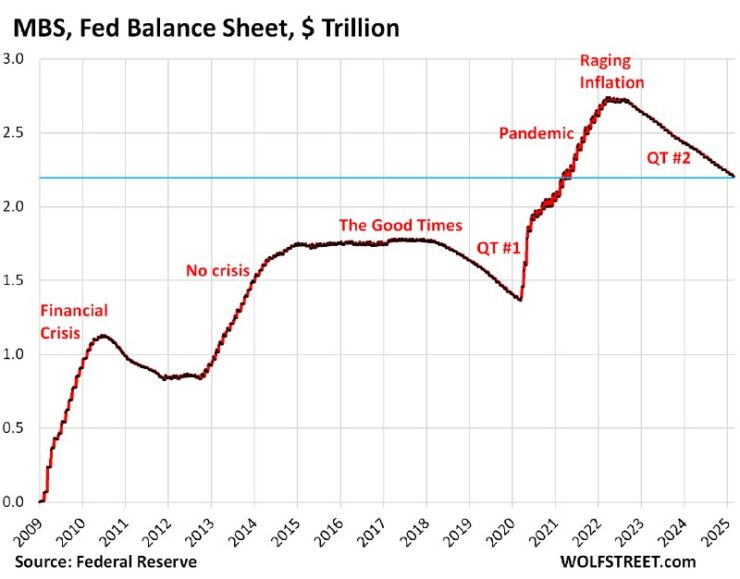

With investors feeling the pain, the natural next step is to call for lower interest rates or more money printing (QE). That’s where the Fed comes in. The central bank says it doesn’t respond to political pressure, but when the markets are in trouble, it’s hard to ignore.

People are imperfect. People have their own limiting beliefs, fears, and everything folds under pressure.

Trump understands this. He knows that if he creates enough uncertainty, the Fed will have no choice but to step in and lower rates or inject liquidity. And when that happens? The markets will likely skyrocket, giving Trump the perfect opportunity to take credit for the recovery.

The Bigger Picture

Trump’s game plan is clear: create the problem, then take credit for the solution. It’s classic persuasion and manipulation, something he’s mastered over the years. If this plays out, we could see a massive rally in the markets, at least in the short term.

But what happens after, a few years from now? The global economy is already facing serious long-term problems, including rising debt levels and economic slowdowns in key regions. The question is whether this short-term boost will lead to an even bigger crisis down the road.

For now, one thing is certain—Trump will do whatever it takes to win, even if it means pushing the Fed into action.

How This Could Impact Equities and Crypto

If Trump successfully pressures the Fed into lowering interest rates or restarting money printing (quantitative easing), the effects on equities and crypto could be significant.

Equities: A Potential Rocket Ship… for Now

Short-Term Boom:

- Lower interest rates mean cheaper borrowing costs, which encourages companies to expand, buy back stocks, and boost earnings.

- More liquidity in the market means more money flowing into stocks, driving up prices.

- If the Fed pivots, expect a V-shaped recovery in equities, with major indices like the S&P 500 and Nasdaq soaring.

Long-Term Risks:

- The artificial market boost could create a bubble, leading to overvalued stocks detached from real economic fundamentals.

- If inflation spikes again, the Fed might have to reverse course, leading to another crash.

- High debt levels and global economic issues mean this isn’t sustainable forever.

Crypto: Liquidity = Explosive Growth

Bitcoin and Crypto Rally:

- Crypto thrives on liquidity and risk appetite. If the Fed turns dovish (lower rates, more money printing), Bitcoin and altcoins could explode upward.

- Institutions and hedge funds, flush with new capital, will diversify into crypto as a hedge against inflation and monetary manipulation.

Retail FOMO & New Highs:

- When equities pump, people feel richer and take bigger risks, leading to more retail money flowing into crypto.

- If Bitcoin breaks key resistance levels, it could set off a new bull run, pushing Ethereum and other altcoins much higher.

- Expect crypto to see increased speculative hype.

Possible Blow-Off Top:

- If money printing and rate cuts push crypto into an overheated rally, we could see a blow-off top followed by a steep correction (similar to previous cycles).

- Regulatory uncertainty and potential government crackdowns could spoil the party at any time.

Bottom Line

If Trump’s strategy works and the Fed caves, expect equities and crypto to skyrocket in the short term.

But if this is just artificial stimulus with no real economic growth behind it, we could be looking at one of the biggest bubbles in history—and a brutal crash when the music stops.