North Korea has overtaken El Salvador and Bhutan in Bitcoin holdings, becoming the fourth-largest sovereign holder of BTC. This unexpected development has sparked speculation over whether the country is deliberately building a Bitcoin reserve as part of its financial strategy.

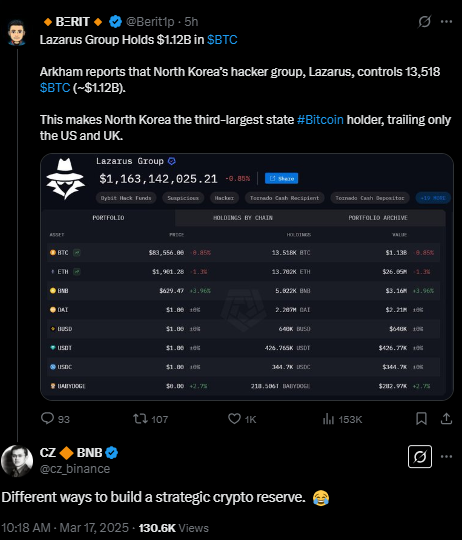

Adding fuel to the discussion, Binance founder Changpeng Zhao (CZ) recently commented on the situation in a playful yet telling X post:

“Different ways to build a strategic crypto reserve 😂”

With North Korea’s BTC stash now worth over $1.13 billion, is this just a result of Lazarus Group’s cyber heists, or is the regime strategically accumulating Bitcoin to bypass global sanctions?

North Korea’s Bitcoin Stash Grows After Bybit Hack

North Korea’s rise in Bitcoin holdings is closely linked to its state-backed hacking collective, Lazarus Group, one of the most notorious cybercriminal organizations in the world.

Following the $1.4 billion Bybit hack, reports indicate that the stolen funds, initially taken in Ethereum (ETH), were largely converted into Bitcoin (BTC).

According to Arkham Intelligence, North Korea currently holds 13,518 BTC, valued at $1.13 billion at Bitcoin’s current price of $83,263.

This sudden accumulation has pushed North Korea past Bhutan and El Salvador in the Bitcoin rankings:

- United States – 198,109 BTC ($16.47 billion)

- China – 195,000 BTC ($16.18 billion)

- United Kingdom – 61,245 BTC ($5.1 billion)

- North Korea – 13,518 BTC ($1.13 billion)

- El Salvador – 10,634 BTC ($886 million)

- Bhutan – 6,118 BTC ($509.5 million)

Despite some reports suggesting North Korea could be the third-largest Bitcoin holder, it actually ranks fourth—still a staggering position for a country financially isolated by sanctions.

The Lazarus Group’s decision to convert stolen Ethereum into Bitcoin has raised questions within the cryptocurrency community. Some possible reasons include:

- Bitcoin’s superior liquidity – BTC is the most widely traded cryptocurrency, making it easier to move large amounts undetected.

- Store of value – Bitcoin’s increasing institutional adoption may make it a safer long-term asset compared to other cryptocurrencies.

- Sanctions evasion – North Korea has long used crypto to bypass global financial restrictions, and Bitcoin’s decentralized nature makes it harder to control.

With the U.S. and China holding massive Bitcoin reserves, some speculate that North Korea may be mirroring this approach, intentionally stockpiling BTC as a hedge against economic restrictions.

A Joke or a Serious Warning?

Changpeng Zhao’s X post on North Korea’s Bitcoin holdings was humorous on the surface but highly suggestive.

The laughter emoji could indicate genuine surprise or be a subtle dig at how North Korea is gaming the system. Either way, his words reinforced speculation that the country is deliberately accumulating Bitcoin as a reserve asset.

His comment also highlights the irony of a highly sanctioned nation building a digital reserve while countries like South Korea and major financial institutions continue debating Bitcoin’s legitimacy.

In contrast to its northern neighbor, South Korea has rejected adopting Bitcoin as a reserve asset.

Lawmakers had proposed exploring BTC reserves, but the Bank of Korea (BoK) dismissed the idea, stating:

While South Korea remains skeptical of Bitcoin’s viability as a reserve asset, North Korea’s increasing exposure to BTC is a reminder that digital currencies are reshaping geopolitical strategies.

What Does This Mean for the Future?

North Korea’s Bitcoin accumulation could have major implications for financial security and global crypto regulation.

- Increased scrutiny on crypto transactions – Governments may push for stricter regulations on exchanges and mixers used by illicit actors.

- More aggressive tracking of Lazarus Group activity – Blockchain forensic firms will likely ramp up efforts to trace and freeze funds linked to North Korea.

- Shifting geopolitical crypto strategies – If Bitcoin continues gaining mainstream acceptance, more nations could start accumulating it as a reserve asset—openly or covertly.

The line between legitimate Bitcoin adoption and illicit accumulation is blurring, making crypto an increasingly important factor in global financial warfare.

Final Thoughts

While the United States has openly accumulated Bitcoin through seizures, North Korea has done so through cybercrime.

Whether intentional or not, North Korea now holds more BTC than some small nations, raising concerns about how it could leverage this digital asset for financial and political advantage.

As global powers race toward Bitcoin adoption, one thing is certain: crypto is no longer just a financial experiment but a geopolitical asset.