Cryptocurrency investors are pulling capital from volatile assets and redirecting funds into stablecoins and tokenized real-world assets (RWAs) ahead of President Donald Trump’s tariff announcement set for April 2. The move comes amid intensifying trade tensions and widespread uncertainty surrounding U.S. economic policy.

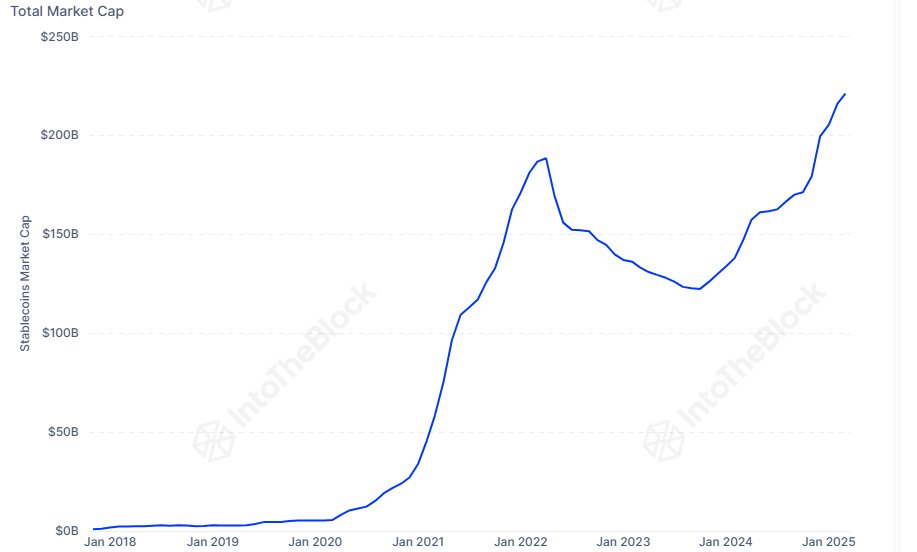

Capital inflows into stablecoins and RWAs have surged in recent weeks, according to blockchain analytics firm IntoTheBlock. In a March 31 X post, the firm wrote, “Stablecoins and RWAs continue to see steady inflows of capital as safe havens in the current uncertain market.” RWAs—blockchain representations of tangible assets like real estate and fine art—are increasingly viewed as lower-risk holdings during turbulent periods.

The shift coincides with a broader pullback across traditional and crypto markets. Since Trump first announced a new wave of tariffs on Chinese goods during his Jan. 20 inauguration, Bitcoin has declined 19 percent. The S&P 500 has fallen over 7 percent in the same period, according to TradingView data.

Market volatility is being driven by both geopolitical developments and broader macroeconomic signals. “Many investors were expecting economic tailwinds following Trump’s inauguration as president,” said Juan Pellicer, senior research analyst at IntoTheBlock. “But increased geopolitical tensions, tariffs and general political uncertainty are making investors more cautious.”

Tariff Fears Drive Liquidity Into Blockchain-Based Assets

The upcoming April 2 announcement is expected to outline reciprocal trade tariffs targeting several major U.S. trade partners. The proposed measures aim to reduce the nation’s $1.2 trillion goods trade deficit and encourage domestic manufacturing. This has triggered inflation-related concerns and broader risk aversion in global markets.

“Risk appetite remains muted amid tariff threats from President Trump and ongoing macro uncertainty,” said Iliya Kalchev, a dispatch analyst at digital asset platform Nexo.

As a result, on-chain assets—particularly RWAs—have become a growing focus for capital allocation. According to RWA.xyz, cumulative RWA value reached an all-time high of over $17 billion on February 3 and is now within 0.5 percent of the $20 billion milestone. Some industry analysts project that RWAs could surpass $50 billion by the end of 2025, driven by growing liquidity and increased participation in the $450 trillion global asset market.

Despite their appeal as a hedge, RWAs and stablecoins are not immune to volatility. “Because these assets reside on-chain, even slight shifts in sentiment can trigger significant price movements,” IntoTheBlock noted. The firm emphasized the real-time nature of capital flows in digital markets, where low transaction barriers accelerate investor responses to emerging events.