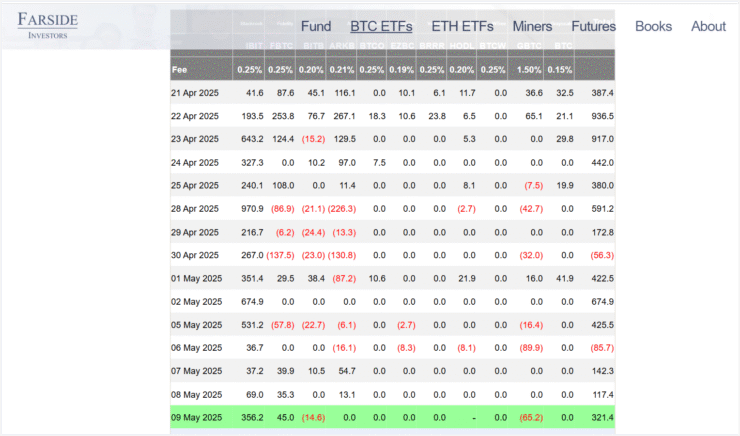

Bitcoin is holding firm above the $100,000 threshold as institutional investors continue to pour money into spot exchange-traded funds (ETFs). On May 7, net inflows across U.S.-based Bitcoin ETFs reached $142.3 million, highlighting the increasing appetite for regulated Bitcoin exposure among traditional asset managers and hedge funds.

Leading the charge was the ARK 21Shares Bitcoin ETF (ARKB) with $54 million in inflows, followed by Fidelity’s Wise Origin Bitcoin Fund (FBTC) at $39 million, and BlackRock’s iShares Bitcoin Trust (IBIT) at $37 million. According to data from Arkham Intelligence, BlackRock also executed a single transaction worth $8.4 million, purchasing over 86 BTC that day.

Alex Obchakevich, founder of Obchakevich Research, said these inflows reflect “sustained institutional interest,” with major financial players relying on ETFs to gain compliant exposure to Bitcoin’s price upside.

With Bitcoin maintaining six-figure support, Wall Street’s growing involvement signals a broader normalization of Bitcoin in institutional portfolios—while also underscoring the central role of regulated investment vehicles in driving price momentum.

ETF Inflows Signal Strength as Bitcoin Tracks Tech Rally

Bitcoin’s rally above $100,000 has been further fueled by ongoing strength in the technology sector and corresponding inflows into spot ETFs. On May 8, net inflows across ETFs totaled another $117 million, extending a multi-day streak of positive momentum.

This time, BlackRock’s IBIT led with $69 million, followed by Fidelity’s FBTC with $35 million, and ARKB with $13 million. The figures highlight the persistent demand from institutional investors, particularly those seeking Bitcoin exposure without the custody and compliance burdens of self-storage.

Obchakevich pointed to a growing correlation between Bitcoin and the Nasdaq Composite Index, citing a 0.75 correlation coefficient. “The Nasdaq’s rally on May 8 and 9 clearly supported Bitcoin’s breakout past $100K,” he said.

He also noted that a $675 million inflow into IBIT on May 2 may have been an early sign of resurgent institutional confidence, helping to set the tone for the market’s bullish shift in May.

GBTC Outflows Driven by Fees and Geopolitical Anxiety

While most ETFs show consistent inflows, the Grayscale Bitcoin Trust (GBTC) continues to see persistent outflows. According to Obchakevich, this is less a bearish signal for Bitcoin and more a reflection of structural inefficiencies and external market risks.

GBTC’s 1.5% management fee remains significantly higher than its newer competitors, prompting many institutional investors to rotate into lower-fee alternatives like IBIT and FBTC.

“The absence of significant outflows in key ETFs other than GBTC supports the hypothesis that the whales and funds remain bullish,” Obchakevich said.

Still, he added that geopolitical anxieties—including rising tensions between India and Pakistan, tariff uncertainty, and ongoing global instability—have dented investor sentiment toward GBTC specifically, making it more vulnerable to capital rotation.

Quick Facts

- Bitcoin ETFs saw $142.3 million in net inflows on May 7 and $117 million on May 8.

- BlackRock’s IBIT led inflows on both days, totaling $106 million across two sessions.

- Ethereum’s growing correlation with the Nasdaq is helping to shape Bitcoin’s price trajectory.

- GBTC continues to face outflows due to high fees and geopolitical investor caution.