The cryptocurrency market is at a crossroads, with institutional investors pouring capital into Bitcoin while retail traders remain despondent over a lackluster altcoin season.

According to Bitwise Asset Management, institutional sentiment is at record highs, while retail investors appear increasingly pessimistic.

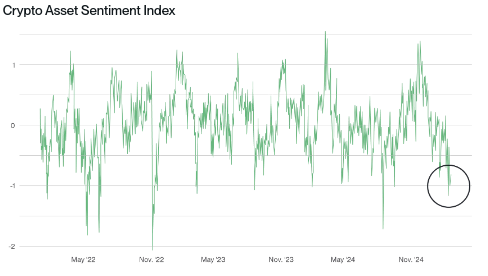

Bitwise Chief Investment Officer Matt Hougan has observed a stark divide between institutional and retail investor sentiment. While Bitcoin exchange-traded funds (ETFs) and corporate acquisitions have fueled a surge in institutional confidence, retail investors remain largely disengaged. Bitwise’s proprietary sentiment score, which analyzes on-chain data, market flows, and derivatives activity, indicates one of the lowest retail sentiment readings ever recorded.

Hougan attributes this downturn in retail enthusiasm to the absence of a pronounced altcoin rally. Despite Bitcoin’s 95% gain over the past year, Ethereum has managed just a 2% increase, with most altcoins posting negative returns. The lack of high-risk, high-reward altcoin volatility—often characterized by rapid gains and speculative fervor—has left retail investors frustrated.

“Retail crypto loves to speculate on altcoins, and the lack of an ‘altcoin season’ has them depressed,” Hougan noted.

A Pivotal Moment for Altcoins?

Despite the bleak sentiment among retail investors, Hougan sees a strong case for optimism. He points to a convergence of factors that could set the stage for an altcoin resurgence, primarily the improving regulatory landscape. Over the past few years, many altcoins have operated in a legal gray area, stifling mainstream adoption. However, recent regulatory shifts—especially around stablecoins—signal a turning point.

“The U.S. has made the growth of stablecoins a national priority, which will support the growth of Ethereum and Solana,” Hougan explained. “Additionally, major institutions now feel safe building on crypto, which will drive DeFi adoption.”

Stablecoin assets under management recently hit an all-time high, and innovative projects like Ondo Finance’s tokenization of U.S. stocks and ETFs further highlight a growing institutional commitment to blockchain technology. While an immediate catalyst for altcoin resurgence remains unclear, Hougan believes that the market will be significantly larger in the coming years.

“In a year or two, my guess is that you’re not going to have to squint to see the transformation in altcoins; the impact will be self-evident and overwhelming,” he predicted.

For now, retail investors appear disillusioned, but institutional capital continues to flow. Whether retail sentiment rebounds in the wake of increased adoption remains to be seen. However, if history is any indicator, pessimism in crypto often signals opportunity.