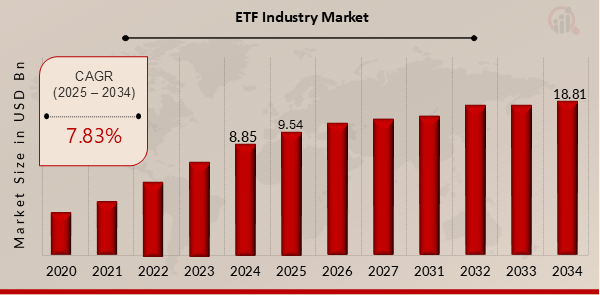

The world of finance has never experienced a cryptocurrency ETF revolution like the one happening right now. It is the combination of new technologies and daring changes that are leading to the transformation of this sector.

But why is this transformation happening? From institutional growth to cutting-edge technologies, the crypto ETF landscape is becoming unrecognizable – and investors around the globe are paying attention.

The Rise of Decentralized Finance in Crypto ETFs

Decentralized Finance (DeFi) is no longer just a trend; it’s the future of finance. Innovations expected to turbo-charge the crypto ETF industry are creating synergies between DeFi protocols and crypto ETFs, bringing forth more efficient, easy-to-access, and transparent investment options.

The manual ETF management process involving banks is now obsolete, thanks to blockchain-based contracts. The scale of diversification attainable is unprecedented at lower costs, enabling millions to gain access.

With such innovation in DeFi, new investors can now confidently participate in the crypto ETF segment with minimal effort.

AI and Machine Learning Revolutionizing ETF Strategies

ETF trends are shaping market growth and innovation, and this can be seen in how artificial intelligence and machine learning are rewriting the rules of ETF portfolio management.

These technologies automatically capture new patterns at lightning speed during heightened volatility through predictive modeling and real-time analytics. For example, sophisticated algorithms analyze complex trading data and market movements in the crypto space.

For the first time, ETF managers can supercharge the returns of their funds in mere minutes instead of months. The combination of cryptocurrencies and AI is sure to give ETF products a leg up.

Regulatory Clarity Paving the Way for Growth

Regulation has long been a concern for the crypto ETF industry, but recent developments are changing that narrative.

Governments and financial regulators are coming to terms with innovations associated with digital assets by creating clearer frameworks for the approval of ETFs and their operations.

The landmark approval of Bitcoin and Ethereum ETFs in major financial centers around the world has had a domino effect in other regions.

This clarity is significantly increasing confidence for institutional investors, which is simultaneously fueling the ever-increasing sophistication of ETF products.

The Future is Here

The changes which will affect the crypto ETF industry are far more fundamental than crypto trends because they are transformational in nature.

Thanks to DeFi, cryptocurrencies, AI and growing regulation, the industry has a bright and secure future. One thing is for sure, as these changes take place, the era of crypto ETFs is just beginning and the opportunities are limitless.