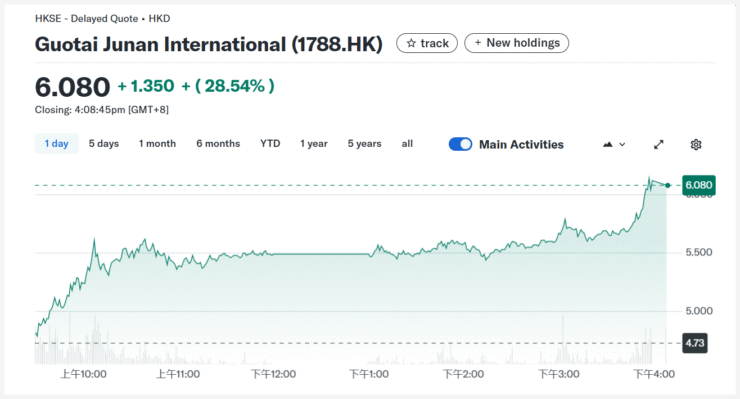

Crypto-linked equities surged on the Hong Kong Stock Exchange Tuesday as investors responded to growing momentum around the region’s stablecoin licensing plans. The rally was led by Guotai Junan International, a Hong Kong-listed Chinese brokerage that recently secured approval to offer crypto trading services. Its shares jumped 28% by midday, according to Yahoo Finance data.

OSL, one of the city’s few fully licensed digital asset exchanges for retail users, also saw significant gains with a 8% rise. The company has been expanding its footprint, announcing in June a $62.4 million acquisition deal for Canadian crypto firm Banxa. Meanwhile, Victory Securities climbed 9.2%, and Dmall Inc., a retail digitalization company with fresh crypto ambitions, gained 8.9%.

The broader excitement reflects growing investor belief that Hong Kong’s push toward becoming a regulated hub for digital assets is gaining traction—especially as firms with early regulatory wins begin to capture market share.

Stablecoin Licensing in Focus Ahead of August Rollout

The strong trading activity follows a series of developments suggesting that stablecoin regulation in Hong Kong is entering an implementation phase. Victory Securities received regulatory approval in April to provide crypto trading services, and Dmall recently revealed its intention to seek a stablecoin license. The company has already begun purchasing Bitcoin via the HashKey exchange as part of its crypto strategy.

Hong Kong’s stablecoin licensing regime, slated to take effect on August 1, will require fiat-referenced stablecoin issuers to obtain licenses from the Hong Kong Monetary Authority. While the framework will impose tighter rules on issuers, it also marks a significant step toward legitimizing stablecoins within the city’s financial infrastructure.

Christopher Hui, Hong Kong’s Secretary for Financial Services and the Treasury, said in an interview published Monday by local outlet Ming Pao that the city may issue its first stablecoin licenses this year. However, he emphasized that approvals would be limited, estimating the number of successful applicants would remain “in the single digits.”

China’s Tech Giants Eye Offshore Stablecoins

The surge in interest also stems from broader geopolitical and economic signals around stablecoins, particularly from mainland China. In June, Pan Gongsheng, Governor of the People’s Bank of China, publicly acknowledged that stablecoins—alongside central bank digital currencies—are beginning to reshape the global financial system.

While Hong Kong’s licensing efforts are currently focused on Hong Kong dollar-pegged tokens, local attention is shifting to the idea of offshore yuan-based stablecoins. Chinese tech giants JD.com and Ant Group are reportedly lobbying Beijing to approve stablecoin frameworks that would allow international deployment of offshore yuan-backed tokens, according to sources cited by Reuters.

Such a development could give China greater influence in global digital payments without directly challenging capital controls at home. For Hong Kong, it also positions the city as a regulatory bridge between mainland ambitions and global stablecoin adoption, a role investors appear eager to price into local markets.

Quick Facts

- Guotai Junan, OSL, Dmall, and Victory Securities led Tuesday’s rally in Hong Kong crypto stocks.

- Hong Kong’s stablecoin licensing regime will go live on August 1.

- Officials say stablecoin licenses may be issued this year but will be few in number.

- Mainland Chinese companies are lobbying for offshore yuan-pegged stablecoins.