As part of its deepening exploration into central bank digital currencies, Hong Kong is collaborating with Chainlink to test a cutting-edge use case that merges traditional finance with decentralized networks. The latest pilot involves Chainlink’s Cross-Chain Interoperability Protocol (CCIP), enabling simulated cross-border transfers between private banking systems and public blockchains.

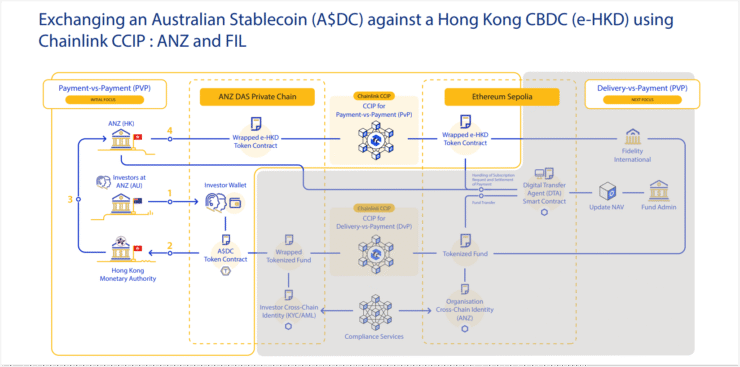

The scenario centers on a theoretical Australian investor aiming to acquire tokenized assets in Hong Kong. The investor initiates the purchase in an Australian dollar–pegged stablecoin, which travels through a network of blockchains before the final asset is delivered in e-HKD—the digital version of Hong Kong’s currency.

This simulation forms part of Phase Two of the e-HKD+ program, where programmable payments, asset tokenization, and atomic settlements are under evaluation to shape the infrastructure of future digital economies. The trial highlights how a single transaction can weave through multiple currencies and blockchains—without losing compliance or finality.

Chainlink’s CCIP Connects Public and Private Blockchain Layers

Chainlink’s Cross-Chain Interoperability Protocol (CCIP) is at the center of the test, acting as the communication layer between blockchain networks. While CCIP already supports dozens of ecosystems—including those built on Ethereum and Solana Virtual Machines—this particular pilot will utilize the Ethereum Sepolia testnet as its technical sandbox.

In partnership with Visa, ANZ, and global asset managers ChinaAMC and Fidelity International, the initiative aims to explore how tokenized transactions can flow seamlessly between permissioned and permissionless environments. The objective is to simulate how a future e-HKD could operate across both regulated and open blockchain infrastructures.

The Hong Kong Monetary Authority (HKMA) launched Phase Two of the e-HKD project in September 2024, with 11 consortiums tasked with testing real-world use cases for a potential CBDC. From programmable payments to cross-border settlements, findings from the pilots are expected to inform the government’s digital currency roadmap, with results due by the end of 2025.

CBDC Momentum Slows Globally, But Regions Push Ahead

The global push for central bank digital currencies (CBDCs) appears to be cooling. A February 2025 survey revealed that just 18% of central banks are actively considering issuing a CBDC—down from 38% in 2022. The shift reflects growing caution, likely due to technical hurdles, regulatory challenges, and mixed public reception.

Despite the broader slowdown, progress continues in key regions. In March, Israel unveiled a prototype of its digital shekel, reaffirming its commitment to advancing the project. In February, the European Union accelerated development of infrastructure for a potential digital euro.

These regional efforts indicate that while the pace has moderated globally, CBDCs remain a strategic priority for economies focused on financial modernization and cross-border interoperability.

Quick Facts

- Hong Kong is piloting e-HKD with Chainlink’s CCIP for cross-border transactions.

- The scenario simulates an Australian investor using stablecoins to acquire e-HKD assets.

- Partners include Visa, ANZ, Fidelity International, and ChinaAMC.

- Only 18% of central banks still actively explore CBDCs, down from 38% in 2022.