Hong Kong’s Legislative Council has officially approved a comprehensive new law to regulate stablecoins, signaling a major step in the city’s bid to become a global digital asset leader.

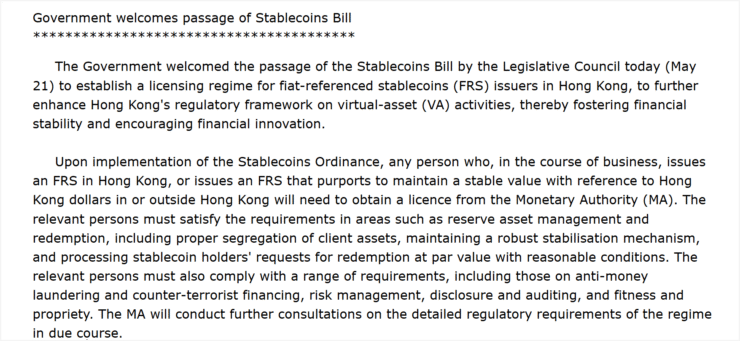

The legislation—known as the Stablecoins Bill—passed its third reading on Wednesday and introduces a mandatory licensing regime for issuers of fiat-referenced stablecoins that operate in or target Hong Kong. Regulatory oversight will be managed by the Hong Kong Monetary Authority (HKMA).

In an official statement, the government confirmed the Stablecoins Ordinance will take effect later this year, with a transitional period to allow industry participants to meet compliance standards. The HKMA will conduct further consultations to finalize technical aspects of the framework.

This move positions Hong Kong ahead of many international jurisdictions by enacting enforceable rules for one of the most critical areas of digital finance—tokens backed by fiat currencies like the U.S. dollar or Hong Kong dollar.

New Law Sets Strict Rules for Stablecoin Issuers

Under the new law, stablecoin issuers must meet rigorous operational and transparency standards. Key requirements include:

- Proper reserve asset management to ensure full token backing and redemption capability.

- Clear mechanisms for client fund segregation and token redemption.

- Robust risk controls, including anti-money laundering (AML) and counter-terrorist financing safeguards.

- Ongoing audits and compliance reporting for regulatory oversight.

The legislation is grounded in a “same activity, same risks, same regulation” approach, according to Secretary for Financial Services and the Treasury Christopher Hui. He emphasized that the framework balances innovation with a risk-based model for market protection.

Stablecoin Bill Seen as Key to Web3 Strategy

Local lawmaker Johnny Ng, who helped shape the bill, described the legislation as a foundational move for Hong Kong’s digital economy. Speaking on X (formerly Twitter), Ng said the real challenge now is building utility for stablecoins beyond regulation.

Issuing stablecoins is just the beginning, Ng noted. He added that the bill lays the groundwork for Web3 development, building on previous initiatives like the crypto exchange licensing regime and the HKMA’s regulatory sandbox for stablecoin experimentation.

That sandbox has already attracted global participants, including Standard Chartered, Animoca Brands, and Hong Kong Telecommunications, signaling early market validation of Hong Kong’s approach.

Hong Kong’s legislative move comes amid growing regulatory activity worldwide. In the U.S., the Senate recently advanced the GENIUS Act—a landmark bill designed to create federal oversight for stablecoins.

Though still subject to debate and amendments, the GENIUS Act marks the most significant progress on stablecoin regulation in the U.S. to date. Industry analysts see Hong Kong’s new law as part of a broader trend toward harmonized frameworks aimed at bringing legitimacy and consumer protection to the digital currency space.

Quick Facts

- Hong Kong has passed a new law requiring licenses for all fiat-referenced stablecoin issuers operating in or targeting the city.

- The law mandates strict compliance rules covering reserves, redemption, audits, and risk controls.

- It forms part of Hong Kong’s strategy to build a regulated Web3 and digital asset economy.

- Global stablecoin regulation is accelerating, with the U.S. Senate advancing the GENIUS Act.