Grayscale Investments has submitted a new proposal to the U.S. Securities and Exchange Commission (SEC) to convert its Digital Large Cap Fund (GDLC) into a spot crypto exchange-traded fund (ETF), aiming to expand access to retail investors through public markets. Originally launched in 2018 as a private placement for accredited investors, the fund holds a diversified basket of top digital assets.

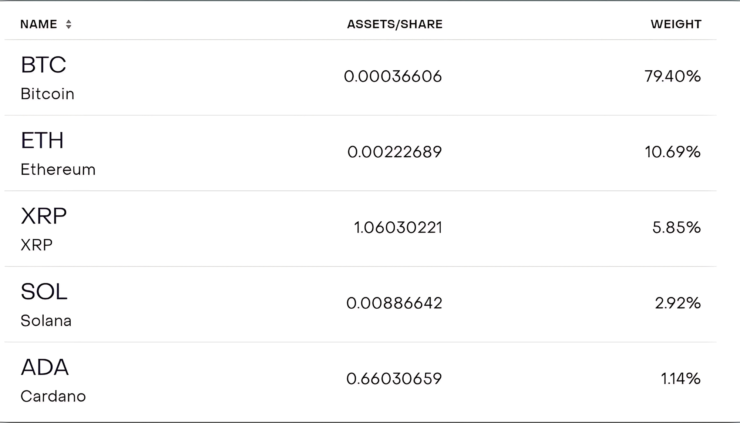

As of the time of filing, Bitcoin makes up the majority of the portfolio at 79.4%. Ethereum follows with 10.69%, while XRP, Solana, and Cardano represent 5.85%, 2.92%, and 1.14% respectively. Cardano was added in January 2025, replacing Avalanche (AVAX) during the fund’s most recent index rebalancing.

The GDLC’s historical performance has also been notable. Since inception, its market price has increased by 478.83%, according to data published on Grayscale’s website. The company said the ETF conversion aims to provide greater liquidity, transparency, and investor protection by bringing the product under a regulated exchange framework.

ETF Conversion Could Broaden Retail Access to Crypto

If approved, Grayscale’s proposed conversion of the Digital Large Cap Fund into a spot ETF would allow retail investors to gain regulated exposure to a diversified basket of major cryptocurrencies—without needing to meet accreditation requirements. The current GDLC product is only available to qualified investors, but an ETF structure would make it tradable on public markets, similar to traditional equity or commodity ETFs.

According to Grayscale’s filing, the portfolio currently represents approximately 75% of the total crypto market capitalization, excluding stablecoins and meme tokens. The submission was made through an S-3 registration statement filed with the SEC on Monday. While much of the fund’s composition is expected to remain the same, details such as the final management fee are still pending.

The application comes amid a surge in crypto-related ETF activity in the United States. Since the SEC’s landmark approval of spot Bitcoin ETFs in January 2024, demand for crypto investment products has grown significantly. Ethereum ETFs followed in May, and a hybrid Bitcoin-Ethereum ETF has also received regulatory approval.

As of this writing, U.S.-listed Bitcoin ETFs collectively manage $97.27 billion in assets under management (AUM), while Ethereum ETFs account for $8.59 billion, according to data from CoinGlass.

Grayscale’s attempt to convert GDLC into a publicly traded ETF marks another milestone in the mainstream evolution of crypto investment products. By offering diversified exposure to multiple leading digital assets in a regulated format, the firm is positioning itself to meet growing investor demand while aligning with evolving regulatory frameworks. If approved, the fund would offer a broader entry point for both institutional and retail investors—potentially ushering in a new phase of market maturity for crypto investing.

Quick Facts

- Grayscale has filed to convert its Digital Large Cap Fund (GDLC) into a spot crypto ETF, making it accessible to retail investors.

- The fund allocates 79.4% to Bitcoin, 10.69% to Ethereum, and smaller shares to XRP, Solana, and Cardano.

- GDLC has returned over 478% since its 2018 inception, according to Grayscale.

- If approved, the ETF would track roughly 75% of the crypto market cap, excluding stablecoins and meme coins, within a regulated framework.