Aleksei Andriunin, the 26-year-old founder of crypto market-making firm Gotbit, has reached a plea deal with U.S. authorities, agreeing to forfeit $23 million worth of cryptocurrency tied to market manipulation charges.

The agreement follows months of legal proceedings, starting with Andriunin’s arrest in Portugal last year and his subsequent extradition to the United States in February.

According to court filings reviewed by Law360, Andriunin’s manipulative trading practices caused significant financial harm to unsuspecting investors, who were misled into purchasing digital assets at artificially inflated prices.

Prosecutors outlined how Gotbit’s operations systematically distorted crypto markets, leaving retail participants bearing the brunt of fraudulent price movements.

The plea agreement allows both the defense and prosecution to withdraw from the deal if the court rejects any of its terms, leaving final sentencing at the court’s discretion. While the agreement suggests Andriunin may avoid prison time and additional financial penalties beyond the $23 million forfeiture, the court has yet to confirm the final outcome.

Andriunin’s cooperation marks a critical development in a case that has drawn considerable attention to the risks posed by unregulated market-making firms in the crypto industry.

Andriunin Faces Heavy Penalties Amid Market Manipulation Conviction

Aleksei Andriunin’s guilty plea has exposed him to the possibility of severe legal consequences, including a maximum sentence of up to 20 years in prison. Federal prosecutors charged Andriunin and his firm Gotbit—alongside three other crypto entities—in October last year, accusing them of wire fraud and conspiracy to manipulate digital asset markets.

According to court documents released by the U.S. Department of Justice (DOJ), Andriunin admitted to orchestrating elaborate schemes that manipulated the prices of low-liquidity cryptocurrencies between 2021 and 2023. By leveraging a network of shell companies and pseudonymous accounts, Andiunin’s firm artificially inflated trading volumes and prices to lure unsuspecting investors into buying tokens at overvalued rates.

These tactics, commonly known as “pump-and-dump” operations, allowed Gotbit to profit significantly while leaving retail traders exposed to severe losses. Prosecutors detailed how the firm used coordinated trading bots, wash trades, and misleading market signals to distort price discovery on decentralized exchanges.

Beyond potential prison time, Andriunin is also subject to hefty financial penalties. Prosecutors outlined maximum fines reaching $500,000 or double the financial gains (or losses) resulting from the manipulation, whichever is greater. Mandatory restitution, civil asset forfeiture, and up to five years of probation could also be enforced depending on the court’s final ruling.

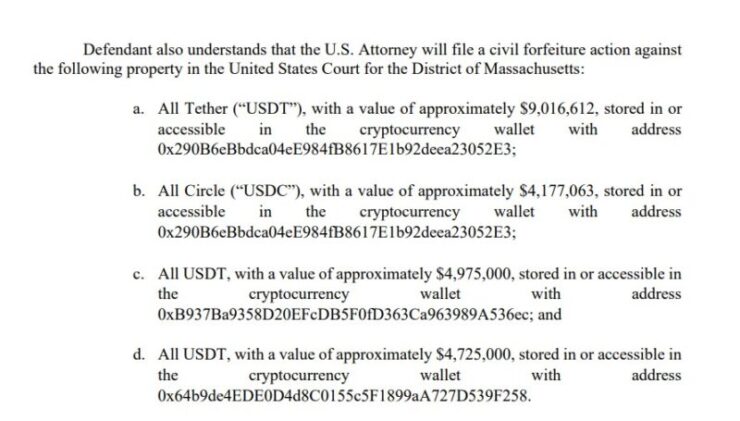

A significant portion of Andriunin’s assets—totaling $23 million—has already been earmarked for forfeiture. This includes large holdings in stablecoins issued by Tether and Circle, spread across four wallets solely under his control. These funds were identified as directly linked to the deceptive market activities Gotbit engaged in, which misled investors and undermined market integrity.

SEC Uncovers Gotbit’s Internal Playbook

In parallel to the criminal proceedings, the U.S. Securities and Exchange Commission (SEC) has filed its own complaint against Gotbit and Fedor Kedrov, identified as the firm’s marketing director.

The regulator’s investigation revealed meticulous records maintained by Gotbit, detailing the extent of its manipulative practices. Specifically, the firm kept internal logs comparing naturally occurring market volumes with volumes artificially generated through their schemes—a clear indicator of premeditated intent to deceive market participants.

Court filings also exposed how Gotbit marketed its services openly, pitching clients on their ability to disguise manipulative trading activities on public blockchains. The firm’s recruitment materials outlined strategies designed to obscure their operations from detection, further aggravating the SEC’s charges.

As part of the plea deal, prosecutors recommended Andriunin to serve three years of supervised release once his sentence concludes. Strict conditions will bar him from participating in any cryptocurrency-related activities during this period, effectively sidelining him from the industry he once exploited.

Quick Facts:

- Gotbit founder Aleksei Andriunin pleaded guilty to market manipulation, agreeing to forfeit $23 million in crypto assets.

- Andriunin was extradited from Portugal to the U.S. in February 2025 after being arrested four months earlier.

- Prosecutors revealed that Gotbit systematically inflated crypto prices, causing financial harm to unsuspecting investors.

- Andriunin faces up to 20 years in prison, with final sentencing pending; the plea deal may spare him additional fines beyond asset forfeiture.