After years of skepticism toward cryptocurrencies, Goldman Sachs has made a decisive pivot. The investment bank, managing nearly $3 trillion in client assets, has significantly increased its holdings of Bitcoin (BTC) and Ethereum (ETH) exchange-traded funds (ETFs), signaling a broader institutional shift toward digital assets.

Regulatory filings reveal that in the fourth quarter of 2024, Goldman dramatically increased its crypto exposure, with a 2,000% rise in its ETH ETF holdings and a 114% surge in its Bitcoin ETF investments.

Goldman Sachs Expands Crypto ETF Holdings

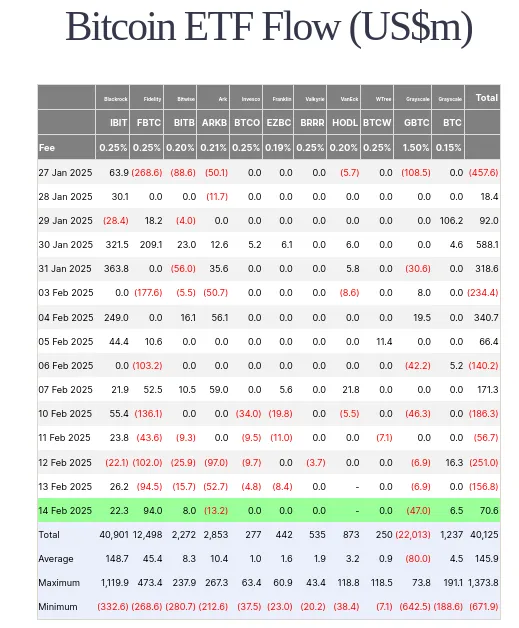

According to its latest Form 13F filing with the Securities and Exchange Commission, Goldman Sachs purchased approximately $1.28 billion worth of shares in the iShares Bitcoin Trust (IBIT), marking a 177% increase from the third quarter. The bank also acquired $288 million worth of shares in the Fidelity Wise Origin Bitcoin Fund, bringing its total Bitcoin ETF exposure to over $1.5 billion.

Meanwhile, Goldman significantly bolstered its Ethereum holdings. The firm expanded its ETH ETF position from $22 million to $476 million, with investments split between BlackRock’s iShares Ethereum Trust and the Fidelity Ethereum Fund. Additionally, it acquired $6.3 million worth of shares in the Grayscale Ethereum Trust ETF.

The bank’s filings also indicate a strategic shift in its investment approach, as it closed positions in Bitcoin ETFs from Bitwise, WisdomTree, and joint offerings from Invesco and Galaxy, as well as ARK and 21Shares. The move suggests a preference for ETFs from industry giants such as BlackRock and Fidelity.

A Broader Institutional Shift Toward Crypto

Goldman Sachs’ embrace of digital assets reflects a broader trend of institutional adoption. The firm initially entered the spot crypto ETF market in the second quarter of 2024, purchasing $418 million worth of Bitcoin ETFs. The continued accumulation of BTC and ETH ETFs suggests growing confidence in crypto assets as legitimate investment vehicles.

This shift coincides with an increasingly favorable regulatory environment, bolstered by the election of pro-crypto President Donald Trump. Wall Street firms are increasingly recognizing the potential of blockchain-based financial instruments, with Bloomberg reporting that Goldman is exploring the launch of its own crypto platform for trading digital assets.

Despite its current enthusiasm, Goldman Sachs has a history of skepticism toward cryptocurrencies. As recently as 2020, the bank dismissed crypto as a viable asset class. Even in April 2024, Sharmin Mossavar-Rahmani, chief investment officer of Goldman Sachs Private Wealth Management, compared crypto enthusiasm to the 17th-century tulip mania, stating, “We do not think it is an investment asset class.” The bank’s latest moves, however, suggest a significant departure from that stance.

With Goldman Sachs increasing its crypto exposure and other major firms following suit, institutional adoption of Bitcoin and Ethereum appears to be gaining momentum. The firm’s latest investments indicate that Wall Street is no longer standing on the sidelines but actively positioning itself in the evolving digital asset space.