Goldman Sachs is making a bold bet on crypto, doubling down on Bitcoin and Ethereum ETFs with a multi-billion-dollar investment in Q4 2024. According to the firm’s February 11 Form 13F filing with the SEC, Goldman’s Bitcoin ETF holdings surged by 114% to $1.52 billion, while its Ether ETF exposure skyrocketed by 2,000%, reaching $476 million.

Goldman’s Expanding Crypto Portfolio

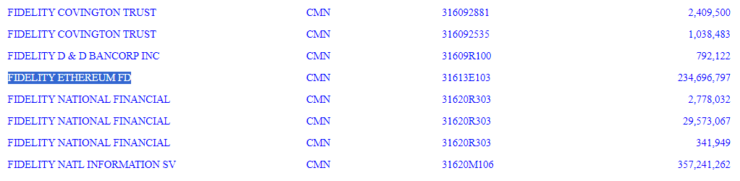

Goldman Sachs ramped up its investment in spot Ethereum ETFs, increasing its stake from $22 million to $476 million. The holdings were split between:

- BlackRock’s iShares Ethereum Trust (ETHA)

- Fidelity Ethereum Fund (FETH)

- Grayscale Ethereum Trust ETF (ETHE) ($6.3 million position)

At the same time, the investment giant nearly doubled its Bitcoin ETF exposure, purchasing $1.28 billion worth of shares in the iShares Bitcoin Trust (IBIT)—a 177% increase from Q3—along with $288 million in Fidelity’s Wise Origin Bitcoin Fund (FBTC). Goldman also holds $3.6 million in the Grayscale Bitcoin Trust (GBTC).

A Shift in Institutional Sentiment?

Goldman’s deeper entry into crypto-backed ETFs reflects a broader shift in institutional sentiment. While the firm previously dismissed Bitcoin and other digital assets as unsuitable investments, its growing crypto exposure suggests an evolving stance. Notably, these increased holdings align with Bitcoin and Ethereum’s Q4 price gains—BTC rose by 41%, and ETH by 26.3%, according to CoinGecko.

Goldman Drops Some ETF Holdings

Despite its expanded crypto exposure, Goldman exited several ETF positions, including:

- Bitwise and WisdomTree Bitcoin ETFs

- Joint offerings from Invesco & Galaxy

- ARK & 21Shares’ Bitcoin ETF

This suggests a strategic shift towards ETFs managed by BlackRock and Fidelity, two of the largest and most reputable asset managers in the crypto ETF space.

Wall Street’s Growing Appetite for Crypto

Goldman Sachs first entered the spot Bitcoin ETF market in Q2 2024, with an initial $418 million investment. The firm’s increased exposure in Q4 indicates that crypto ETFs are becoming a staple in institutional portfolios.

Beyond ETFs, Goldman has been exploring further crypto adoption. Bloomberg reported in November that the bank is considering launching a blockchain-based trading platform for financial instruments, potentially expanding its role in digital asset markets.

From Crypto Skeptic to Crypto Investor

Goldman Sachs’ growing involvement in crypto ETFs is particularly interesting given its historical stance on digital assets. Since 2020, the firm has repeatedly questioned Bitcoin’s legitimacy as an asset class. Even as recently as April 2024, Sharmin Mossavar-Rahmani, Goldman’s Private Wealth Management CIO, compared the crypto market to the tulip mania of the 1600s and stated:

“We do not think it is an investment asset class. We’re not believers in crypto.”

Despite such skepticism, Goldman’s multi-billion-dollar exposure to crypto ETFs suggests that market demand and institutional adoption may be outweighing past concerns.

What This Means for Institutional Crypto Adoption

Goldman Sachs’ aggressive push into Bitcoin and Ethereum ETFs reflects a broader trend of mainstream financial institutions increasing their crypto exposure. Key takeaways from this development include:

- Growing Institutional Confidence: Wall Street is increasingly embracing Bitcoin and Ethereum ETFs as a legitimate investment vehicle.

- Selective Investment Strategy: Goldman is concentrating its holdings in BlackRock and Fidelity ETFs, potentially signaling trust in established asset managers.

- Regulatory Influence: With an improving regulatory environment, financial giants are more willing to participate in crypto markets.

As Goldman Sachs and other major institutions continue to expand their digital asset investments, the legitimacy and stability of the crypto market are likely to strengthen. While skepticism remains, the numbers speak for themselves, institutional crypto adoption is in full swing.