Goldman Sachs has significantly expanded its stake in BlackRock’s iShares Bitcoin Trust (IBIT), increasing its holdings by 28% amid a historic surge of inflows into the fund. The move cements Goldman’s position as IBIT’s largest known institutional holder, signaling growing Wall Street confidence in Bitcoin’s role as a portfolio mainstay.

According to newly filed SEC documents, Goldman now owns 30.8 million shares of IBIT—valued at approximately $1.4 billion—marking a sharp rise from its Q1 position. The bank also holds 3.5 million shares of Fidelity’s Wise Origin Bitcoin Fund (FBTC), worth around $315 million, as it deepens exposure across multiple spot Bitcoin ETFs.

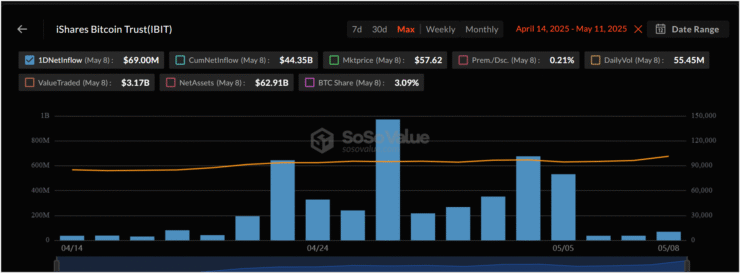

IBIT, which launched in January, has now recorded net inflows on 20 consecutive trading days—more than any other spot Bitcoin ETF in 2025. Data from SoSoValue shows the fund brought in around $5.1 billion over that period, pushing the total asset value of all U.S.-based spot Bitcoin ETFs past $121 billion.

Bloomberg ETF analyst Eric Balchunas highlighted IBIT’s dominance in a recent post on X, noting that the gap between IBIT and its competitors may be driven by hedge funds returning to basis trades and high-net-worth individuals seizing on Bitcoin’s spring rally.

Goldman’s aggressive move into crypto ETFs comes amid a wave of renewed institutional interest in digital assets. With Bitcoin reclaiming six-figure territory and macro sentiment leaning bullish, traditional finance powerhouses are allocating serious capital to regulated crypto products at an accelerating pace.

Goldman Eyes Stablecoin Legislation as Catalyst for Crypto Growth

Goldman Sachs’ increased activity in crypto follows a broader strategic shift in its posture toward digital assets. For the first time this year, the firm directly addressed crypto in its annual shareholder letter, marking a symbolic pivot for one of Wall Street’s most storied institutions.

According to Mathew McDermott, Head of Digital Assets at Goldman Sachs, pending U.S. legislation on stablecoins could serve as a watershed moment for the digital finance sector. Speaking at the Token2049 conference, McDermott emphasized that clearer regulatory guidance on stablecoins would help unlock mainstream financial adoption.

“If regulations allow stablecoins to be easily adopted by financial institutions, this could accelerate the use of digital currency by big players,” he said.

Goldman’s push into Bitcoin ETFs also mirrors a broader trend among legacy institutions. BlackRock—the issuer behind IBIT—recently held closed-door meetings with the SEC’s Crypto Task Force to explore the future of crypto derivatives and staking within ETF frameworks.

This follows a broader shift in tone at the SEC, where top officials have reportedly begun more constructive engagement with industry leaders under pressure from both Congress and the White House. The agency is said to be re-evaluating its enforcement-first approach, with new guidance and rulemaking now on the horizon.

Together, these developments signal a rapidly maturing crypto investment landscape—one where Bitcoin, stablecoins, and tokenized financial instruments are becoming integrated into the foundations of global finance.

Quick Facts

- Goldman Sachs now holds 30.8 million shares of IBIT, valued at $1.4 billion.

- IBIT has logged 20 consecutive days of net inflows, totaling $5.1 billion.

- Goldman’s crypto expansion includes $315 million in Fidelity’s FBTC ETF.

- Goldman’s digital asset head says stablecoin legislation could unlock mass institutional adoption.

- The SEC is engaging more directly with asset managers and may soon roll out crypto-focused rules.