A Gibraltar court has frozen $7 million worth of cryptocurrency belonging to Web3 gaming firm Ready Makers Inc., as part of an ongoing legal battle between the US-based Ready Makers (Ready Games) and its Gibraltar subsidiary, Ready Maker (Gibraltar) Limited. The dispute centers around allegations that the subsidiary’s CEO, Christina Macedo, unlawfully took control of the firm and its PLAY token, which is used as a rewards mechanism on the Ready Games platform.

Legal Battle Over Control of PLAY Token

In a February 11 statement, Ready Games revealed that nearly 440 million PLAY tokens close to half of the total circulating supply were transferred to a court-appointed custodian. The Supreme Court of Gibraltar also issued an order earlier this month to freeze over 450 million PLAY tokens, preventing any attempts to relocate the company or move the assets.

The ruling affects over 300 million tokens held by the Gibraltar-based PLAY Network, as well as nearly 151 million tokens that Ready Games claims ownership over.

Claims of Misappropriation and Breach of Trust

Ready Games asserts that Macedo and PLAY Network breached trust arrangements by wrongfully claiming ownership of Ready Gibraltar and its assets, including the PLAY token. The company claims that its court action is aimed at recovering control of its Gibraltar subsidiary, which was initially meant to serve as a token launch vehicle.

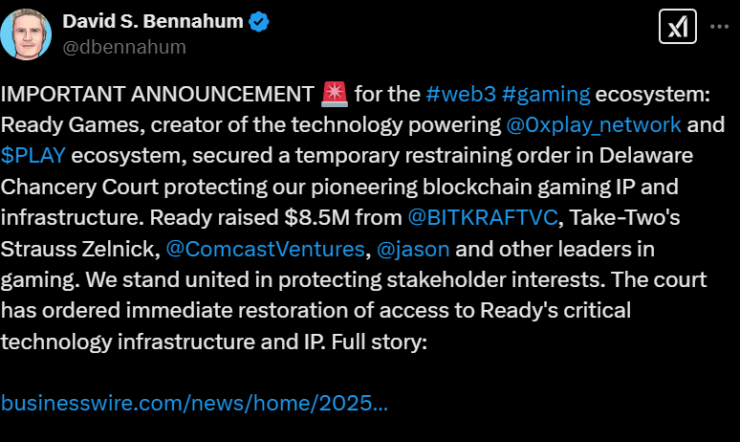

“Ready Games developed this infrastructure with funding from leading gaming investors. Ready Gibraltar seized control of that technology and falsely claimed to have developed it independently,” said Ready Games founder David S. Bennahum.

In a separate case, a Delaware business court recently issued a temporary restraining order, requiring PLAY Network to restore Ready Games’ access to critical technology infrastructure, including its GitHub repositories, cloud systems, and domain accounts.

Market Impact and Response

The PLAY token, which launched in December 2023, has suffered a steep price decline, dropping over 12% in the last 24 hours to a market value of $13.2 million, according to CoinGecko. The token had previously peaked at $78.1 million in mid-December, when its price hit $0.19, but has since declined over 90%, now trading at just over $0.015.

Broader Implications for Crypto Gaming Governance

This case highlights the challenges of corporate governance and asset control within the Web3 gaming industry. As blockchain-based companies expand globally, disputes over ownership, technology rights, and token governance are becoming more common.

The outcome of this legal battle could set a precedent for crypto gaming firms, influencing how tokenized assets and platform governance are managed in decentralized ecosystems. Meanwhile, regulatory bodies may look more closely at corporate structures and governance policies to ensure greater accountability in the crypto gaming sector.

For now, the Gibraltar court’s ruling signals a significant victory for Ready Games, though the long-term implications for PLAY Network and its operations remain uncertain.