In a dramatic escalation of Europe’s stablecoin oversight, Germany’s financial regulator BaFin has ordered Ethena GmbH to halt the sale of its USDe token and freeze its reserves, marking one of the first major enforcement actions under the EU’s Markets in Crypto-Assets Regulation (MiCAR).

The decision underscores growing global scrutiny over algorithmic stablecoins, particularly those struggling to prove reserve backing and regulatory compliance.

After months of investigation, BaFin concluded that Ethena violated MiCAR by offering USDe and sUSDe tokens without an approved prospectus. Regulators flagged the tokens as potential unregistered securities, citing major compliance gaps around capital requirements and reserve transparency.

In response, BaFin froze the reserves backing USDe, shut down Ethena’s website, and barred the firm from onboarding new clients, though secondary market trading remains active.

Regulators clarified that relying on pre-MiCAR transitional rules was not enough. Ethena’s framework failed to meet updated requirements designed to safeguard investors in the fast-evolving stablecoin market.

Ethena Pushes Back — Claims Reserves Are Secure

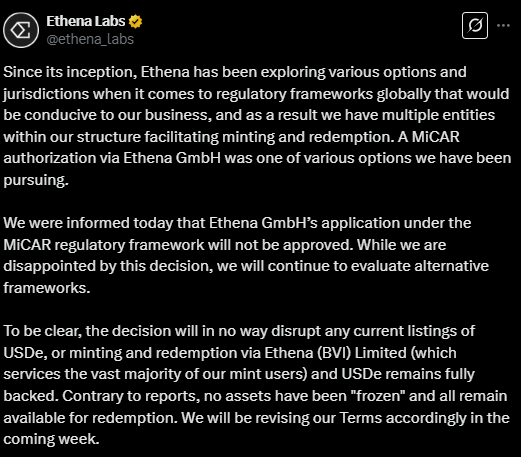

Ethena Labs called BaFin’s move “disappointing”, insisting that USDe reserves remain fully intact. In a statement, the company assured users that redemption services continue uninterrupted through its British Virgin Islands (BVI) entity, Ethena BVI Limited.

The firm stressed that most of the 5.4 billion USDe tokens in circulation were issued outside Germany before MiCAR took effect. Still, the regulator’s action raised serious concerns over Ethena’s regulatory readiness — especially as European rules tighten.

Ethena’s case highlights a broader regulatory shift. Under MiCAR, the European Union is prioritizing stablecoin transparency, reserve verification, and investor protection — signaling that lightly regulated digital assets will no longer fly under the radar.

BaFin’s enforcement echoes growing fears around algorithmic stablecoins, whose complex hedging models could break down under market stress. Experts warn that without robust reserves, such tokens risk repeating failures like TerraUSD’s collapse — a scenario MiCAR was designed to prevent.

This crackdown aligns with a global push for stricter stablecoin oversight. In the United States, lawmakers demand fully-backed reserves, while Singapore enforces mandatory redemption frameworks to ensure liquidity and investor safety.

As algorithmic models face rising skepticism, regulators send a clear message — stablecoins must either prove their backing or face the consequences.

The Takeaway

BaFin’s swift action against Ethena could set a precedent across Europe and beyond. The era of leniency is over for projects operating under old assumptions.

As global regulators tighten control, the future belongs to stablecoins that can demonstrate transparency, maintain strong reserves, and meet ever-stricter compliance standards — or risk being frozen out of key markets altogether.