Singapore-based Genius Group is laying out an ambitious roadmap to turn courtroom victories into Bitcoin reserves and shareholder dividends. In a Thursday statement, the AI-powered education technology firm said its board has signed off on a framework to distribute any future proceeds from two major lawsuits that together seek over $1 billion in damages.

One of the legal actions—a Racketeer Influenced and Corrupt Organizations Act (RICO) lawsuit—is targeting LZGI International and claims more than $750 million in damages. A second lawsuit is still pending filing, according to Genius Group CEO Roger Hamilton.

Hamilton noted that based on 2023 data alone, the company believes it is entitled to at least $262 million in compensation, a figure expected to rise once 2024 and 2025 damages are accounted for.

“These cases are about holding defendants accountable for harm to our shareholders,” Hamilton said.

“The board has determined that 100% of any recoveries should be returned to investors or strategically deployed to strengthen our business.”

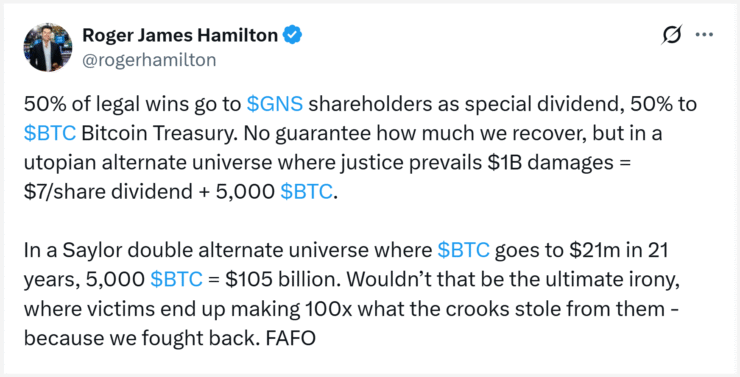

Plan to Split Legal Proceeds Between Dividends and BTC

Under the proposal, half of any successful settlements or court awards will be paid directly to shareholders as a special dividend. The remaining 50% would be used to acquire Bitcoin for Genius Group’s treasury.

If both lawsuits result in full recoveries, Genius shareholders could see payouts totaling $7 per share. At the same time, the company could amass approximately 5,000 BTC—worth over $535 million at current prices around $107,000 per Bitcoin.

Management emphasized that future proceeds from additional litigation would follow the same formula: an equal split between investors and further Bitcoin accumulation.

Still, the company acknowledged in the filing that there is “no guarantee of any outcome” in the legal proceedings and no certainty of receiving any damages or settlements.

Aggressive Bitcoin Strategy Gains Momentum

The lawsuit funding plan is only the latest in Genius Group’s rapid pivot toward Bitcoin. Earlier this month, the company announced it had expanded its BTC treasury by more than 50% through a series of purchases, part of an ongoing goal to accumulate 1,000 Bitcoin.

The pivot has not been without controversy. Genius was previously barred from selling shares and raising funds to finance crypto buys, a restriction that was lifted after about a month.

Genius joins a growing list of public firms betting their balance sheets on Bitcoin as a hedge against inflation and currency volatility.

Norwegian crypto platform Block Exchange recently saw its stock surge over 130% after unveiling plans to build a corporate BTC treasury. French blockchain firm The Blockchain Group disclosed an additional 182 Bitcoin purchase in June, boosting its holdings to 1,728 BTC.

Meanwhile, Norwegian company K33 has announced plans to raise equity funding to buy up to 1,000 BTC, and South Korea’s Parataxis Holdings launched a Bitcoin treasury platform targeting institutional investors.

The moves come as MicroStrategy, Metaplanet, and other high-profile firms continue to scale up their Bitcoin reserves, fueling debate about whether such aggressive accumulation strategies are visionary or reckless.

Quick Facts

- Genius Group is pursuing over $1 billion in damages across two lawsuits.

- 50% of any recoveries will be distributed to shareholders as dividends.

- The remaining 50% will fund new Bitcoin acquisitions, potentially adding 5,000 BTC.

- The company recently lifted a ban preventing it from raising funds to buy crypto.

- Global companies from Europe to Asia are similarly expanding Bitcoin treasuries.