Singapore-based artificial intelligence firm Genius Group says it has been temporarily blocked from expanding its Bitcoin holdings after a U.S. court order barred the company from selling shares, raising capital, or using investor funds to buy more Bitcoin.

A New York District Court issued the preliminary injunction (PI) and temporary restraining order (TRO) on March 13, stemming from an ongoing legal dispute related to the company’s merger with Fatbrain AI, Genius Group said in an April 3 statement.

Genius Group and Fatbrain AI finalized a merger and purchase agreement in March 2024, but by October 30, Genius moved to terminate the deal through arbitration, alleging fraud by Fatbrain AI executives involved in the transaction.

The injunction has disrupted Genius Group’s ambitious Bitcoin treasury strategy, which aimed to allocate 90% or more of its reserves to Bitcoin. The company began building its treasury in November 2024, starting with a $10 million purchase of 110 BTC and setting a target of $120 million in holdings.

As of early April 2025, Genius Group held 440 BTC, worth over $23 million. However, to maintain operations amid the legal freeze, the firm says it was forced to sell 10 Bitcoin and warns that additional sales may be necessary if the court order remains in place.

“Genius is taking all necessary measures to minimize Bitcoin sales but anticipates that it will need to downsize its Bitcoin Treasury in the coming months in the event the PI remains in place,” the company stated.

Legal Battle with Fatbrain AI Intensifies

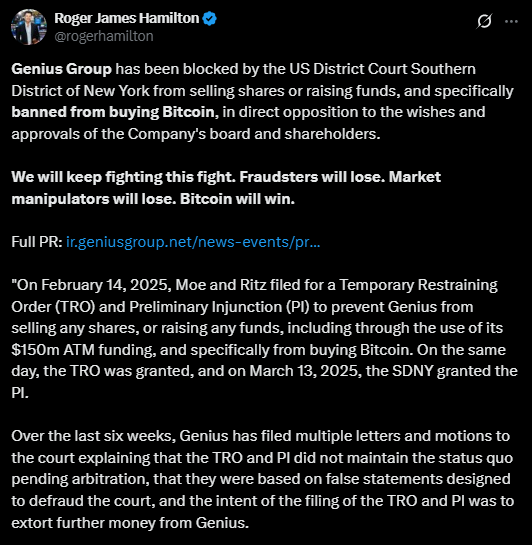

The dispute dates back to October 2024, when Genius Group initiated arbitration to terminate its merger with Fatbrain AI, alleging fraud on the part of Fatbrain executives. In response, Michael Moe and Peter Ritz—executives at Fatbrain AI—filed for the TRO and permanent injunction in February 2025.

The legal order has not only impacted Genius Group’s crypto strategy but has also forced it to shut down divisions, pause marketing efforts, and halt employee share compensation, which the company says violates Singapore labor law.

Further complicating matters, shareholders of Fatbrain AI have filed two separate lawsuits, one against the company’s executives and another naming Genius Group as a defendant, for alleged violations of U.S. federal securities laws in connection to the merger.

Genius Group was voluntarily dismissed from those suits on Feb. 14, but the legal cloud over both companies continues to grow.

Stock Performance Tanks

Genius Group’s share price reflects the turbulence. The stock closed down 9.8% in the latest session at $0.23, with an additional drop to $0.22 after hours, according to Google Finance. That’s a steep fall from its all-time high of over $96 in June 2022—a loss of over 99% in value.

Despite the legal freeze, CEO Roger James Hamilton remains bullish on Bitcoin.

“We will also continue to fly the flag for Bitcoin, even when legally banned from building our Bitcoin Treasury. We believe Bitcoin ensures transparency and prevents exactly the kind of wire fraud and shareholder fraud that are the subject of the current lawsuits.”