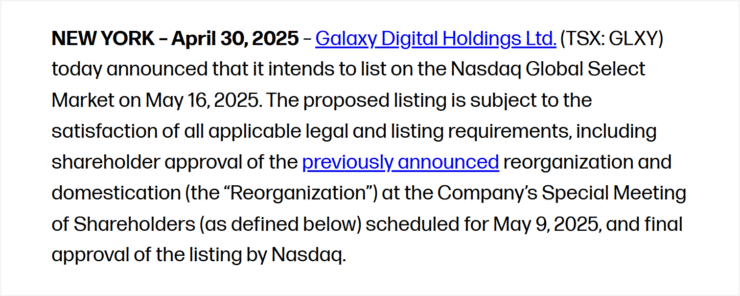

Galaxy Digital is preparing to transition from the Toronto Stock Exchange (TSX) to a Nasdaq listing, with a debut planned for May 16, pending final shareholder approval. The move marks a strategic shift as the crypto investment firm looks to expand its footprint in U.S. capital markets and deepen investor access to its digital asset and AI-driven offerings.

The timing aligns with a rebound in crypto-related equities, as investor sentiment improved in April following months of volatility. Nasdaq-listed firms with crypto exposure posted double-digit gains, reversing previous declines driven by macroeconomic uncertainty.

Galaxy CEO Mike Novogratz called the move a “transformative milestone”, stating that listing on the Nasdaq would help Galaxy become a gateway for investors to safely access digital asset and artificial intelligence markets.

“We believe that listing on the Nasdaq would mark a transformative milestone for Galaxy that would position us to advance our vision of building a gateway for investors to safely and efficiently access every corner of the digital asset and artificial intelligence ecosystems,” Novogratz said.

With an investment scope spanning blockchain and AI infrastructure, Galaxy aims to position itself at the intersection of traditional finance and digital innovation—especially as demand for exposure to these sectors regains momentum.

Nasdaq Move Aims to Expand U.S. Investor Reach

Galaxy shareholders will vote on the transition plan on May 9. If approved, the firm will continue trading on the TSX, where it first went public in July 2020, until the Nasdaq debut is finalized. The dual-market approach is designed to broaden investor access, particularly in the U.S. capital markets.

While Galaxy’s stock has declined 12.28% year-to-date on the TSX, the firm remains focused on long-term expansion. The Nasdaq 100 index has also posted a 7.33% decline in 2025, though April’s rally has prompted some analysts to argue that the market downturn may have been overstated.

Galaxy’s U.S. listing strategy reflects a bet on growing institutional interest, improved regulatory clarity, and the rising appeal of digital assets and AI as mainstream investment themes.

Novogratz Doubles Down as Market Sentiment Shifts

A longtime crypto advocate, Mike Novogratz is deepening his firm’s involvement in the digital asset space. Galaxy’s venture arm, Galaxy Ventures Fund I LP, is on track to raise $175–$180 million by the end of June. The capital will support a portfolio of 30 startups focused on blockchain, Web3, and digital finance.

The fundraising push comes amid a broader market rebound. Crypto equities have shown strong performance in recent weeks, coinciding with renewed investor optimism following policy-driven volatility, including new U.S. tariffs under former President Trump.

According to Google Finance, Coinbase (COIN) rose 17.80%, MicroStrategy (MSTR) surged 31.86%, and CleanSpark (CLSK) gained 21.58% in April alone—helping to boost confidence in the sector as Galaxy prepares its Nasdaq entry.

These market gains, combined with Galaxy’s active expansion and capital deployment, could position the firm as a leading institutional player in the digital asset ecosystem.

Quick Facts

- Galaxy Digital plans to list on Nasdaq on May 16, pending shareholder and regulatory approvals.

- The firm is relocating to Delaware to benefit from a favorable U.S. business environment.

- Crypto equities, including Coinbase and CleanSpark, posted double-digit gains in April.

- Galaxy Ventures Fund I is nearing its $180M fundraising goal to support early-stage crypto startups.