FTX’s bankruptcy estate is preparing to release over $5 billion in recovered funds to creditors at the end of this month, marking a key milestone in the exchange’s efforts to reimburse users following its collapse in 2022.

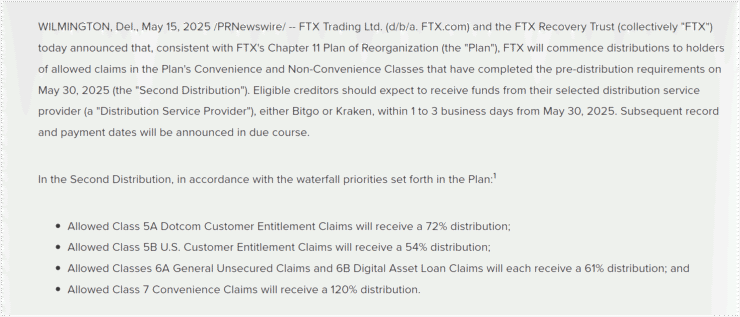

The FTX Recovery Trust announced Thursday that the next phase of distributions will begin on May 30, targeting four major creditor classes. Depending on the classification of their claims, creditors will recover between 54% and 120% of the value of their holdings, as measured at the time of the company’s bankruptcy in November 2022.

“These first non-convenience class distributions are an important milestone for FTX,” said FTX Recovery Trust plan administrator John J. Ray III.

“The scope and magnitude of the FTX creditor base makes this an unprecedented distribution process.”

Class 5 creditors—which include Alameda Research trading partners, lenders, and vendors—will receive between 54% and 72% of their approved claims. A separate group of smaller, unsecured creditors is slated to receive 61%, while claims tied to internal corporate relationships will receive up to 120%.

The May payouts mark the second major tranche of distributions after a February round that reimbursed over $1 billion to creditors with claims of $50,000 or less. These efforts are part of the broader goal to return billions in assets to victims of what was once one of the crypto industry’s most influential firms.

Kraken and BitGo to Process FTX Payouts

Beginning May 30, crypto platforms Kraken and BitGo will begin processing the $5 billion in distributions to eligible FTX creditors. According to the FTX Recovery Trust, recipients should receive funds within one to three business days after processing begins.

This coordinated disbursement adds to what has become one of the largest bankruptcy payout operations in crypto history. It also serves as a signal to the industry that large-scale recovery and resolution is possible—even amid extraordinary financial failure.

The backdrop for these repayments is a crypto industry undergoing a policy and sentiment shift. Nearly three years after FTX’s implosion, the digital asset market is rebounding, powered by regulatory clarity and pro-crypto developments in Washington.

Under President Donald Trump’s administration, the SEC has scaled back aggressive enforcement, and landmark approvals for spot Bitcoin and Ethereum ETFs have fueled renewed investor confidence. State treasuries and corporations are also exploring on-chain asset reserves, reinforcing crypto’s legitimacy in mainstream finance.

FTX Recovery Plan Expands to Reach Final Creditor Classes

The May 30 distribution is part of the Recovery Trust’s second phase, aimed at settling the remainder of outstanding creditor claims. This follows a successful first round that focused on claimants owed $50,000 or less.

That initial phase, launched in February, delivered over $1 billion in payments to thousands of smaller creditors—primarily retail investors and small business partners. According to the trust, those payments were completed efficiently, setting the stage for larger and more complex disbursements in Q2.

This second tranche targets a smaller cohort representing less than 10% of the total creditor base who had not yet received funds. Once completed, these distributions will bring the bankruptcy process closer to resolution—capping off one of the most scrutinized legal and financial unwindings in the crypto era.

Quick Facts

- FTX will distribute over $5 billion to four creditor classes starting May 30.

- Eligible creditors will receive between 54% and 120% of their claim values.

- Kraken and BitGo will process the payouts within one to three business days.

- The second tranche follows a February round that returned $1B to smaller creditors.