Stablecoin issuer First Digital has redeemed nearly $26 million worth of FDUSD stablecoins following a short-lived depegging event triggered by allegations of insolvency made by Tron founder Justin Sun.

On April 2, First Digital’s FDUSD fell as low as $0.87, far below its intended 1:1 U.S. dollar peg, after Sun publicly accused the firm of misappropriating customer funds and violating regulatory standards.

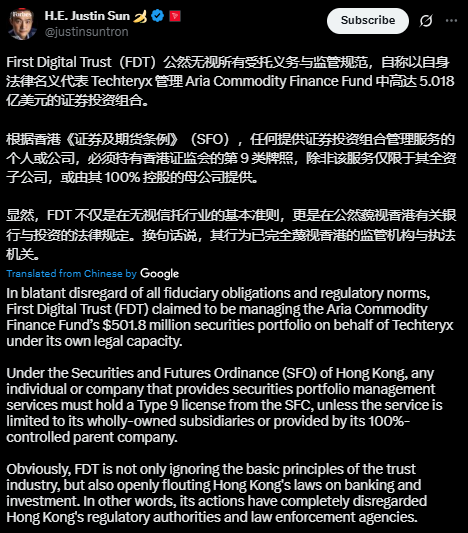

Sun doubled down on April 4, alleging that $456 million in client funds were secretly transferred by First Digital Trust (FDT) to a private Dubai-based entity, without user authorization. He also claimed that the move breached Hong Kong securities regulations.

“FDT transferred $456 million of its custodial clients to a private company in Dubai without their authorization and has not yet returned the money,” Sun said in a post on X.

Despite the accusations, on-chain data from Etherscan confirms that First Digital processed approximately $25.8 million in redemptions shortly after the incident, burning the corresponding FDUSD supply in accordance with standard stablecoin mechanisms.

“We continue to process redemptions smoothly, demonstrating the fortitude of $FDUSD,” First Digital posted on April 3.

First Digital emphasized that FDUSD remains fully redeemable and fully backed, countering the insolvency narrative circulating in the market.

Stablecoin Risks and Market Reaction

FDUSD’s brief depeg underscores the broader concerns around stablecoin reliability, especially following major collapses in the sector.

Gracy Chen, CEO of Bitget, told Cointelegraph that stablecoin instability presents a more serious systemic risk to the crypto ecosystem than even a Bitcoin crash.

“Stablecoins are integral to liquidity, DeFi, and user trust,” Chen said. “Depegs can cause cascading failures like the TerraUSD collapse in 2022.”

Chen further criticized the lack of transparency in the stablecoin market, pointing to Tether’s audit gaps, USDC’s banking exposure, and the overall fragility of algorithmic stablecoins.

“To mitigate risks, the market should enforce real-time audits, prioritize high-quality collateral like U.S. Treasurys, strengthen regulatory oversight, and diversify stablecoin usage,” she added.

Echoes of Terra’s Collapse

The situation brings back memories of TerraUSD (UST), the now-infamous algorithmic stablecoin that lost its peg in May 2022, sparking a multi-billion dollar collapse. UST’s depeg led to the fall of LUNA, a top 10 crypto at the time, and ultimately erased over $40 billion in market value.

As the dust settles, FDUSD appears to have recovered, currently trading near its peg at $0.9962. First Digital has not indicated whether it will pursue legal action over Sun’s claims but maintains that its financial position remains sound.