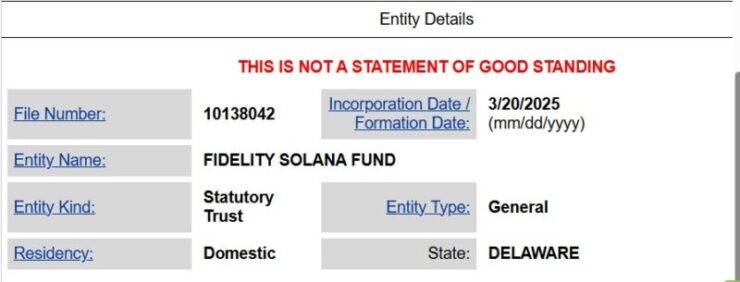

A recent filing by CSC Delaware Trust Company has revealed that asset management firm Fidelity has registered a new entity titled “Fidelity Solana Fund.” The filing, (#10138042 )made public on Thursday, is widely seen as a preparatory step toward potentially launching a Solana-based exchange-traded product (ETP) in the U.S. market.

The move follows Fidelity’s successful track record in the crypto ETF space, notably managing the Fidelity Wise Origin Bitcoin Fund (FBTC), which ranks as the second-largest spot Bitcoin ETF globally. FBTC currently holds approximately $16.5 billion in assets under management, trailing only behind BlackRock’s iShares Bitcoin Trust.

The Delaware filing positions Fidelity to offer institutional investors indirect exposure to Solana (SOL), a blockchain network known for its high-speed transactions and low fees. Delaware’s favorable corporate regulations have long attracted financial firms looking to establish trusts ahead of ETF applications—a pattern Fidelity previously followed in its Bitcoin and Ethereum fund launches.

Asset Managers Ramp Up Solana ETF Efforts

Fidelity’s registration of its Solana fund is the latest move in an escalating competition among major asset managers looking to capture the growing institutional demand for Solana-based investment products. The firm’s filing closely follows similar steps by rivals, including Bitwise and Franklin Templeton, both of which established Delaware trusts tied to Solana and proceeded to submit applications with the U.S. Securities and Exchange Commission (SEC) for spot Solana ETFs.

Despite these efforts, the SEC has so far rejected applications from several prominent firms—namely VanEck, 21Shares, Bitwise, and Canary Capital—citing concerns over regulatory readiness and market structure. According to Bloomberg ETF analyst James Seyffart, the SEC has yet to formally engage with the latest round of Solana ETF proposals, leaving market participants uncertain about the timeline for approval.

Meanwhile, BlackRock, the largest player in the digital asset ETF space, has not publicly disclosed any concrete plans regarding a potential Solana ETF. When asked recently, Rachel Aguirre, head of U.S. iShares products at BlackRock, declined to comment on the firm’s position regarding Solana-specific funds.

The flurry of recent filings captures the growing interest in diversifying crypto investment offerings beyond Bitcoin and Ethereum, as asset managers race to secure early market advantage in anticipation of eventual regulatory green lights.

Growing Institutional Interest in Solana

Institutional interest in Solana continues to accelerate, as traditional financial firms expand their focus beyond Bitcoin and Ethereum to include emerging Layer 1 blockchain platforms. Solana’s appeal is largely driven by its fast transaction speeds, low fees, and an expanding ecosystem that spans decentralized finance (DeFi), NFTs, and Web3 applications.

Major players are moving quickly to capitalize on this momentum. Grayscale already offers a Solana Trust product, while Franklin Templeton recently filed for a Solana ETF, notably proposing to distribute staking rewards as income to investors—a unique feature that reflects the evolving approach to crypto fund structures.

Further fueling institutional interest, asset manager Volatility Shares announced plans to launch two Solana futures ETFs next week. These include the Volatility Shares Solana ETF (SOLZ), providing exposure to Solana futures contracts, and the Volatility Shares 2X Solana ETF (SOLT), which offers leveraged returns.

Quick Facts:

- Fidelity registered the “Fidelity Solana Fund” under a Delaware Statutory Trust, potentially signaling plans for a future Solana ETF.

- The firm already manages the world’s second-largest spot Bitcoin ETF, holding approximately $16.5 billion in assets.

- The Delaware filing provides institutional investors indirect access to Solana (SOL), known for its fast transactions and low fees.

- Fidelity’s move follows a similar strategy used in its earlier Bitcoin and Ethereum fund launches.