Market analysts are closely watching the U.S. Federal Reserve’s next policy move as a potential trigger for Bitcoin’s next major rally. With traders already pricing in two rate cuts in 2025, the timing of those decisions could determine whether Bitcoin pushes past its previous highs—or stalls just short.

According to Carlo Pruscino, market analyst at CMC Markets, a surprise rate cut could have a significant impact on crypto markets.

“An earlier-than-expected cut would strongly influence Bitcoin’s trajectory,” he explained, highlighting $112,000 as a key psychological resistance level among traders.

The broader message is clear: Bitcoin’s price movements are becoming increasingly correlated with macroeconomic signals. As the digital asset cements its place in institutional portfolios, it is now reacting more directly to the decisions of central banks—especially those from the U.S. Federal Reserve.

With inflation risks still present and economic growth cooling, the next few weeks could be decisive. Whether Bitcoin crosses $112K may hinge on whether the Fed accelerates its monetary easing plans—or holds steady a while longer.

Tariff Uncertainty Clouds Fed Decision Despite Strong Data

Bitcoin’s recent surge to an all-time high of $111,970 was followed by a cooldown, with the asset now trading around $102,766. While bullish sentiment remains, attention has turned to the Fed’s June 18 rate decision as a potential macro inflection point.

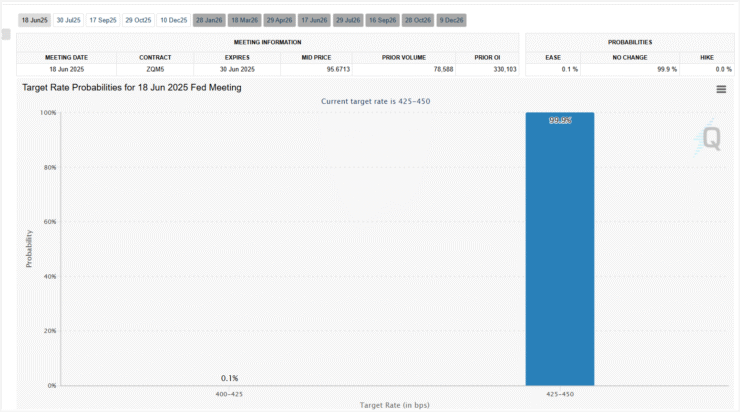

CME’s FedWatch Tool indicates a 99.9% probability that the central bank will hold rates steady between 4.25% and 4.50%. But beyond the data lies a complicating factor: geopolitical tension, especially surrounding Trump’s proposed tariffs.

Pruscino noted that while the Fed has ample economic data to guide its choices, ongoing uncertainty around U.S. trade policy could delay any aggressive rate moves. “They’ve said it themselves—the unknown is trade and tariff policy,” he emphasized. Without clearer signals on that front, investors may remain hesitant.

For Bitcoin to retest and break above $112,000, Pruscino argued, the market will need more than dovish Fed language—it will also need assurance that global trade conditions won’t worsen.

All Eyes on June 6 Jobs Report for Fed and Bitcoin Direction

As Bitcoin hovers near $102,000, traders are now focused on the next key macro signal: the U.S. jobs report scheduled for June 6. According to Pruscino, this data release could heavily influence the Fed’s policy stance and, by extension, Bitcoin’s short-term direction.

The backdrop includes a fresh legal battle over Trump’s tariff plans. A federal court ruling briefly paused the rollout of new tariffs, but an appeals court quickly reversed the decision—paving the way for Trump to double tariffs on imported steel and aluminum to 50%. This adds a volatile element to the Fed’s decision-making calculus.

Pruscino noted that while U.S. economic activity has shown signs of slowing, a strong jobs report—anything over 250,000 new jobs—could shift expectations.

“If we get a number that high, the market may interpret it as a reason for the Fed to hold off on any immediate rate cuts,” he said.

Such a scenario could dampen appetite for risk assets, including Bitcoin, which has become increasingly reactive to shifts in rate expectations and economic data.

Quick Facts

- Analysts say early Fed cuts could drive Bitcoin past $112K

- Bitcoin briefly hit $111,970 before cooling to around $102,766

- CME FedWatch shows 97.5% chance of no rate change on June 18

- Trump’s tariff plans add uncertainty to the Fed’s outlook

- June 6 U.S. jobs report could determine next crypto market move