The Federal Reserve held interest rates steady for the fourth consecutive time, signaling a cautious stance despite persistent inflation pressures. Fresh projections released Wednesday indicate that officials still expect two quarter-point cuts this year, though Fed Chair Jerome Powell warned against overinterpreting the dot plot forecasts.

“No one holds these rate paths with a great deal of conviction,” Fed Chair Jerome Powell said during Wednesday afternoon’s press conference.

The Fed also adjusted its economic outlook, forecasting that core Personal Consumption Expenditures (PCE) inflation will end 2025 at 3%, up from March’s 2.7%. The unemployment rate is now projected to rise slightly to 4.5%, while GDP growth is expected to slow to 1.4%, down from 1.7%.

Asked about the timing of potential rate cuts, Powell called it “very, very hard to say,” but reiterated that reductions remain on the table if inflation cools and the broader economy stays resilient.

Crypto Markets Stay Flat After Fed Announcement

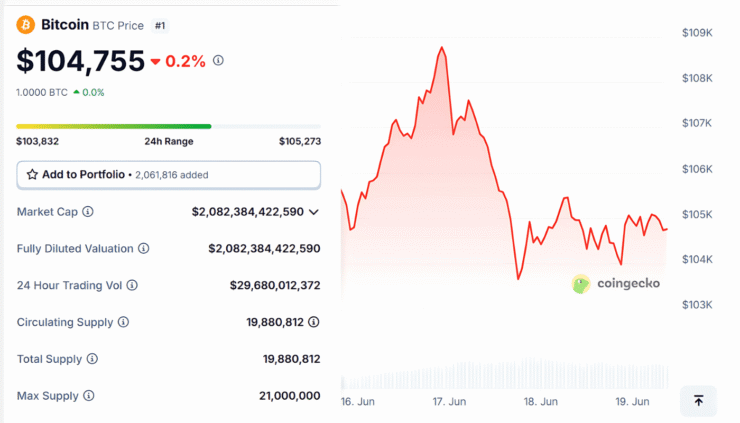

Bitcoin hovered just above $104,750 following the Fed’s decision, showing minimal movement despite the central bank’s policy update. The token remains roughly 5% below its late-May high, and Ethereum also traded flat.

Solana posted a small gain, but most altcoins continued their month-long slump. The muted market reaction was widely anticipated, with CME’s FedWatch Tool showing a 99% probability of a rate hold ahead of the announcement.

With no surprises in Powell’s comments and macro conditions still uncertain, traders largely stayed on the sidelines.

Speaking on a recent episode of the Coinrock show, Mark Connors, a 35-year Wall Street veteran, macro risk strategist, and author behind the widely followed “Risk Dimensions” Substack gave an insight into the Feds recent decision making from the Macro point of view:

“In September, they lowered by not 25, but 50. I guess they had a growth scare. I didn’t think, and the market obviously didn’t think, that it was a reasonable response.” he quipped

Fed Cites Risks, Ignores Trump’s Criticism

Despite recent inflation data showing signs of cooling, the Fed refrained from easing rates. The May Consumer Price Index rose just 0.1% month-over-month, with annual inflation now at 2.4%, close to the Fed’s 2% target.

However, officials remain wary of external risks—including President Trump’s escalating tariff measures and rising geopolitical instability in the Middle East. These factors could reignite price pressures even as core data softens.

Trump has been openly critical of Chair Powell, calling him “stupid” and accusing the Fed of dragging its feet. He insists that his policies are not inflationary and that rate cuts are overdue.

For crypto markets, the Fed’s pause suggests tighter liquidity for now—a key factor in Bitcoin’s long-term momentum.

Quick Facts

- The Fed held interest rates steady at 4.25%–4.50% on Wednesday.

- Officials still project two rate cuts in 2025 despite inflation risks.

- Bitcoin remained flat post-announcement, trading near $104,250.

- Trump slammed Powell, urging faster cuts amid global uncertainty.