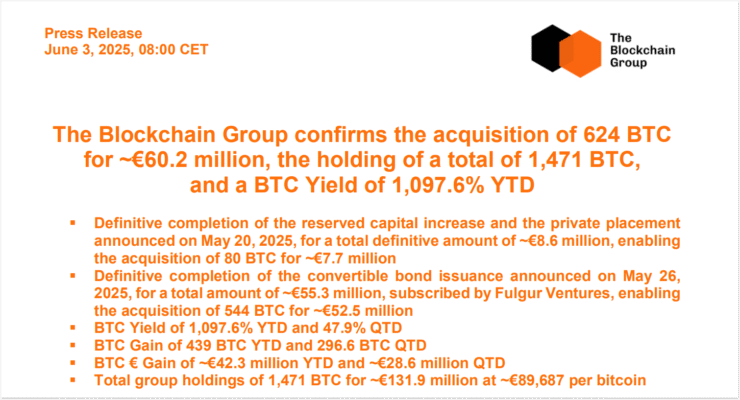

Paris-based Blockchain Group has expanded its Bitcoin holdings with a fresh purchase of 624 BTC, valued at approximately $68.7 million, strengthening its reputation as one of Europe’s boldest corporate adopters of cryptocurrency.

The June 3 announcement brings the company’s total holdings to 1,471 BTC, now worth over $154 million. Blockchain Group—positioning itself as Europe’s first dedicated Bitcoin treasury vehicle—reported a staggering 1,097.6% year-to-date return on its BTC portfolio, reinforcing Bitcoin’s growing role as a legitimate treasury reserve asset.

This latest move comes amid intensifying institutional interest, largely catalyzed by the U.S. Securities and Exchange Commission’s approval of spot Bitcoin ETFs in January 2024. These regulated vehicles have streamlined access to Bitcoin exposure for traditional asset managers and corporations.

Momentum accelerated in March when former U.S. President Donald Trump signed an executive order proposing the creation of a national Bitcoin reserve funded by crypto assets seized from federal criminal cases. The move was widely seen as a policy nod to Bitcoin’s strategic importance.

As global regulatory clarity improves and more financial institutions test the crypto waters, Blockchain Group’s assertive strategy signals Europe’s growing appetite for institutional-grade Bitcoin exposure—suggesting the continent may soon play a larger role in shaping the next chapter of the digital asset economy.

Bitcoin Whales Accumulate While Europe’s Corporate Adoption Lags

Despite Bitcoin’s rising profile as a treasury asset, most European companies remain hesitant. Early movers like France’s BNP Paribas, Switzerland’s 21Shares AG, VanEck Europe, Jacobi Asset Management in Malta, and Austria’s Bitpanda stand out as rare examples of corporate participation in an otherwise cautious landscape.

Even so, momentum is building. The Czech National Bank recently indicated openness to including Bitcoin in its foreign exchange reserves—a significant signal from a traditional financial authority.

Meanwhile, market analysts believe Bitcoin is in a short-term consolidation phase. After hitting a record high of $112,000 on May 22, Bitget Research’s Ryan Lee predicts the asset will trade between $103,000 and $108,000 in the near term. However, Lee emphasizes that on-chain metrics show continued whale accumulation, a historically bullish indicator.

“Still, onchain data shows continued whale accumulation, which shows a bullish signal; this frames any further corrections as a potential entry point,” Lee noted.

Global Bitcoin Treasury Race Heats Up: Strategy and Metaplanet in Focus

The corporate race to stack Bitcoin is intensifying across the globe, with major players in both the U.S. and Asia fueling the shift toward a Bitcoin treasury standard.

At the forefront is Strategy (formerly MicroStrategy), which remains the world’s largest corporate holder of Bitcoin. According to Arkham Intelligence, the firm’s BTC holdings now exceed $60.5 billion, just $8.3 billion shy of overtaking BlackRock’s iShares Bitcoin Trust ETF, currently the largest institutional Bitcoin product.

Strategy deepened its lead with a $75 million BTC purchase between May 26 and 30, buying at an average price of $106,495 per coin. To continue funding acquisitions, the company announced a $250 million stock offering on June 2 via a new class of perpetual preferred shares.

Meanwhile, in Japan, Metaplanet is emerging as Asia’s answer to MicroStrategy. The firm disclosed a $118 million Bitcoin investment on June 2, propelling it into the eighth-largest corporate BTC holder worldwide.

Together, Strategy in the West and Metaplanet in the East represent a growing consensus: Bitcoin is no longer a fringe financial experiment—it’s a global corporate asset class.

Quick Facts

- Blockchain Group purchased 624 BTC for $68.7M, raising its total to 1,471 BTC.

- The firm claims a 1,097.6% YTD return on its Bitcoin treasury.

- Institutional Bitcoin adoption is accelerating post-spot ETF approvals and Trump’s executive order.

- Strategy holds over $60.5B in BTC; Metaplanet invested $118M to become a top 10 holder.

- Whale accumulation continues as Bitcoin trades in the $103K–$108K range.