The EU has blacklisted Moscow-based crypto exchange Garantex, accusing it of enabling Russian banks to bypass sanctions and funnel billions through digital assets. The move is aimed at curbing the use of digital assets to bypass financial restrictions imposed on Russian entities.

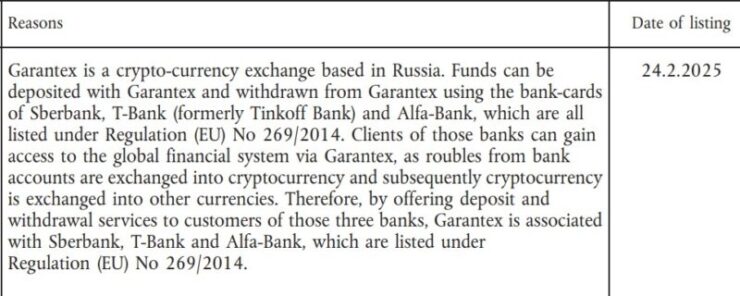

According to the EU’s implementation notice, Garantex was sanctioned due to its ties with Russian financial institutions, including Sberbank, T-Bank, and Alfa-Bank—three banks that have been under EU sanctions since 2014. The exchange allegedly facilitates the conversion of Russian rubles into cryptocurrency, enabling customers of these restricted banks to gain access to the global financial system.

The latest sanctions were announced by Kaja Kallas, the EU’s High Representative for Foreign Affairs and Security Policy, as part of broader efforts to mark the three-year anniversary of Russia’s military incursion into Ukraine. By targeting Garantex, the EU aims to tighten restrictions on Russia’s ability to leverage crypto markets for financial transactions and evade international sanctions.

Garantex’s Sanctions Evasion Activities

The EU’s recent decision to sanction Garantex follows similar actions taken by the U.S. and UK in previous years, with authorities labeling the platform as a major enabler of illicit financial activity. The U.S. Office of Foreign Assets Control (OFAC) sanctioned Garantex in 2022, describing it as a “ransomware-enabling virtual currency exchange,” while the UK imposed its own restrictions in 2023.

According to Isabella Chase, Head of Policy for the UK and EU at blockchain analytics firm TRM Labs, Garantex has played a significant role in facilitating financial crimes since its inception in 2019.

“It is the worst offender by far when it comes to facilitating sanctions evasion and other illicit activity,” Chase told Decrypt.

TRM Labs’ research shows that in 2024, Garantex—alongside Iran’s Nobitex—accounted for more than 85% of crypto inflows to sanctioned entities and jurisdictions, with Garantex being the bigger culprit.

The exchange has been linked to transactions involving cybercriminals, darknet markets, and ransomware groups like Conti. It was also a key financial channel for Hydra Market, a now-defunct Russian darknet marketplace that was shut down in 2022. Despite already being sanctioned by multiple governments, Garantex has continued to process billions of dollars in crypto transactions annually, operating largely within Russia’s regulatory framework.

Broader Scope of the 16th Sanctions Package

Beyond Garantex, the EU’s latest sanctions encompass a range of measures designed to tighten economic constraints on Russia. These include a ban on primary aluminum imports, restrictions on the sale of gaming consoles, and prohibitions against third-country airlines operating domestic flights within Russia. Additionally, the sanctions list has been expanded to include numerous vessels involved in evading existing sanctions.

Quick Facts:

- Garantex, a Moscow-based cryptocurrency exchange, has been added to the EU’s sanctions list due to its ties with previously sanctioned Russian banks.

- This action is part of the EU’s 16th sanctions package against Russia, which also includes bans on primary aluminum imports and certain aviation activities.

- The move reflects the EU’s efforts to prevent the use of digital assets in circumventing international financial sanctions.